Japanese Yen Technical Analysis Talking Points:

- The Japanese Yen has been sliding gradually against the US Dollar

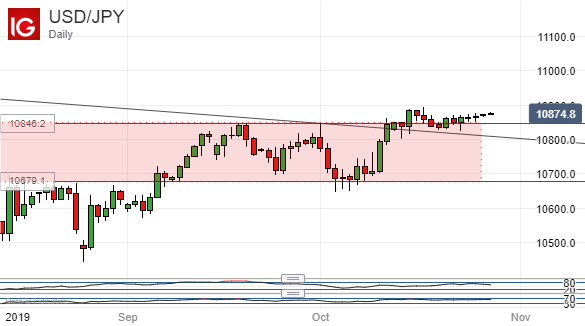

- USD/JPY has nosed above its previous downtrend

- It has also topped an important range, but hardly convincingly. That range top is now near-term support.

Join our analysts for live, interactive coverage of all major Japanese economic data at the DailyFX Webinars. We’d love to have you along.

The Japanese Yen continues to slide against the US Dollar but bulls of the latter still have work to do if they’re to nail down their gains.

Fundamentally the tide may have turned a little against the anti-risk Yen, with signs of progress evident in .

Sure enough USD/JPY remains above both its previously dominant downtrend and a trading range which has been important since May of this year.

Since then however the pair has struggled to remain outside that band for very long, whether it has broken above or below the range. Its current foray above the range top has already seen it slide back inside once, and the last few sessions have evinced the narrow daily trading ranges which can indicate a lack of confidence in the market overall.

USD/JPY bulls’ first order of business will be to prove that they have the stamina to remain above the range top for the long haul. They are unlikely to make this case unless they can take the pair durably above the previous significant high. That was 108.95, October 17’s intraday peak. Although this is by no means far from the current market, it has not given way since.

Until it does a return to range top support at 108.46 will be likely, with a downward trek deeper into the range very possible, even if the base, at 106.79, remains comfortably far away.

However, assuming risk appetite holds up through this week’s plentiful economic events, it seems likely that the Dollar’s uptrend will eventually resume even if it looks a bit mired presently. With that in mind any slips back into the range may simply be better opportunities to add to long positions.

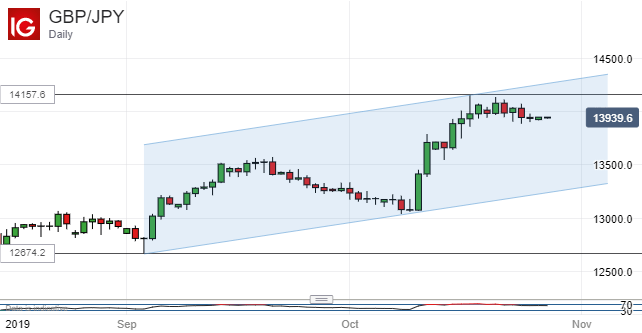

The British Pound has perhaps consolidated its October bounce in better style than might have been accepted. The agreement of a Brexit deal between the EU and London provided the impetus and the cross has remained close to its subsequent five-month highs since even as the agreement has been subject to further parliamentary delay.

Technically the pair can look to support at the 137.00 area from mid-October. That looks safe enough for now, and it’s as well for Sterling bulls that it does because a breach would put the entire second leg of this rise in doubt and increase focus on the 130.90 support region where the Pound bounced on October 9.

Japanese Yen Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!