To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- USD/JPY Technical Strategy: Flat

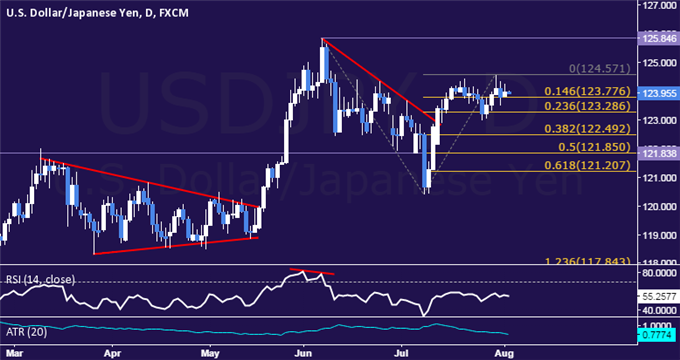

- Support: 123.78, 123.29, 122.49

- Resistance: 124.57, 125.85, 126.63

The US Dollar remains in digestion mode after rising to the strongest level in almost two months against the Japanese Yen. A daily close above the July 30 highat 124.57 exposes the June 5 top at 125.85. Alternatively, a turn below the 14.6% Fibonacci expansion at 123.78 opens the door for a test of the 23.6% level at 123.29.

The available trading range is too narrow to justify entering a trade on the long or short side from a risk/reward perspective. With that in mind, we will remain flat for now, waiting for price action to offer a more compelling opportunity down the road.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com