USD/CHF Price - Technical Forecast

- Bulls pullback after pressing USD vs CHF to its highest level in 2020

- Will bears lead press USD/CHF further?

Price U-Turn

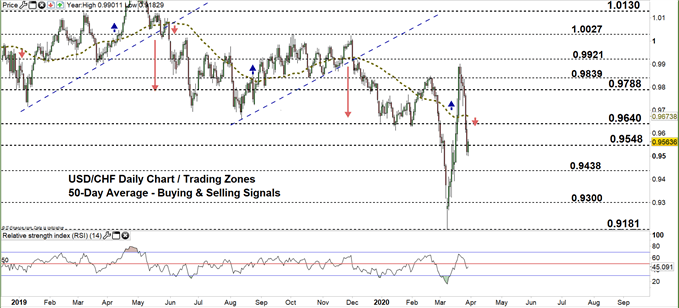

On March 20, USD/CHF took off to 0.9901 -its highest level in over three and half months. The market retreated after, as some bulls seemed to cut back. Last week, more bulls eased up causing a further decline. On Friday, the price printed 0.9505 then closed the weekly candlestick in the red for the first time in three weeks with 3.4% loss.

Alongside that, the Relative Strength Index (RSI) crossed below 50, highlighting the end of uptrend move and a possible start of downtrend momentum.

USD/CHF Daily Price Chart (MAR 15, 2018 – MAR 30, 2020) Zoomed Out

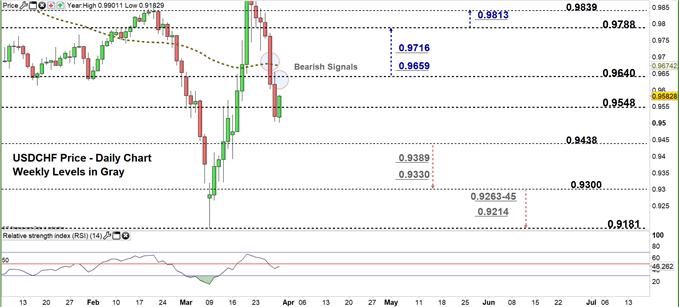

USD/CHF Daily Price Chart (Aug 13 – MAR 30, 2020) Zoomed IN

From the daily chart, we noticed that on Thursday USD/CHF declined and remained below the 50-day average generating a bearish signal. In the following day, the price moved to a lower trading zone 0.9438 – 0.9548.

Thus, a close above the high end of the zone reflects bear’s hesitation. This may increase the likelihood of a rally towards 0.9640. Further close above that level could extend this rally towards 0.9788. That said, the daily resistance levels underscored on the chart (zoomed in) would be worth monitoring.

In turn, a close below the low end of the zone could encourage bears to press towards 0.9300 handle. Further close below that could send USDCHF even lower towards 0.9181. In that scenario, the weekly support level and area marked on the chart should be kept in focus as some traders might exit/join the market around these points.

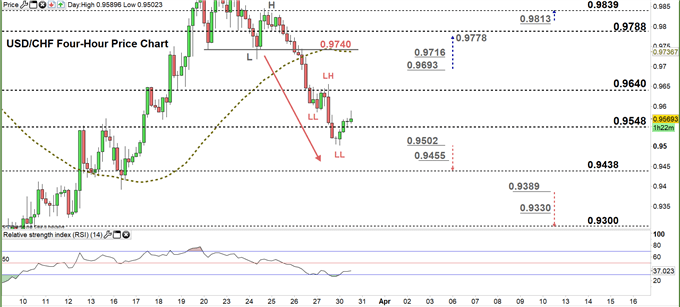

USD/CHF Daily Four-Hour Chart (MAR 5 – MAR 30, 2020)

Looking at the four-hour chart, we noticed that on Tuesday USD/CHF broke below 0.9740 and started a downtrend move creating lower highs with lower lows.

Thus, a break below 0.9502 could resume bearish price action towards 0.9438. Although, the weekly support level underlined on the chart should be considered. On the other hand, any break above 0.9693 would be a bullish signal. This may send USDCHF even higher towards 0.9778. Yet, the daily resistance level printed on the chart should be watched closely.

See the chart to know more about the key technical levels in a further bullish/bearish scenario.

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi