Talking Points:

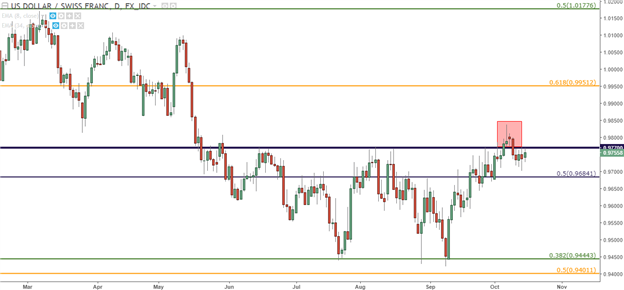

- USD/CHF set a fresh four-month high earlier in the month as USD-strength continued into Q4.

- Price action fell back-below a key level last week, and we’re now seeing resistance show around prior support.

- Want to see the DailyFX Q4 Forecast on USD? Click here for full access.

To receive James Stanley’s Analysis directly via email, please sign up here

While much of the world has been watching Euros, U.S. Dollars and British Pounds, the Swiss Franc has begun to show a series of interesting setups. In USD/CHF, the pair finally broke above resistance at .9770 earlier in the month as USD-strength continued into the open of Q4. Bulls were unable to sustain the top-side break, however, and after prices retraced back below that prior point of resistance, a range had developed over the final few days of the week.

USD/CHF Hourly: Dollar-Driven Bullish Run Loses Steam Above .9770 Resistance

Chart prepared by James Stanley

Given the prior proclivity of the pair to stick to range-like, mean-reversion tendencies; combined with the prior support and resistance structure that had set-in, this could become usable for traders forward-looking approaches in USD/CHF.

USD/CHF Daily: Bulls Unable to Sustain Breakout Above .9770

Chart prepared by James Stanley

Continued resistance around the .9770 level opens the door for short-side setups. Traders can look at stops above either of the two recent swing highs, with aggressive stances looking above .9808 while more conservative takes will likely want to look above .9737. Short-side targets can be investigated at the prior swing-low around .9707, at the Fibonacci level around .9684, the prior swing around .9650 and then .9575.

USD/CHF Hourly: Lower-High, Resistance at .9770 Opens Door for Short-Side Setups

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX