Canadian Dollar Outlook

- Canadian Dollar price action against US Dollar

- USD/CAD technical analysis and chart

USD/CAD – Sellers Hold Fire

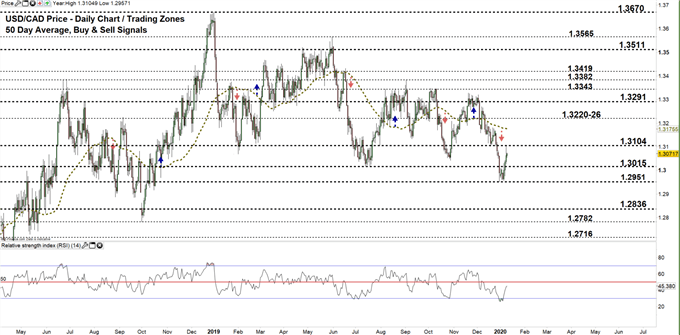

Last week, USD/CAD printed 1.2951 -its lowest level in over fourteen months. However, the price rallied after as some sellers took profit. On Friday, the price closed in the red with a 0.6% loss. This week, more sellers exited the market allowing the pair to rally further.

Alongside that, the Relative Strength Index (RSI) abandoned oversold territory. However, the oscillator remained below 50 reflecting paused downtrend momentum.

Just getting started? See our Beginners’ Guide for FX traders

USD/CAD DAILY PRICE CHART (Jan 5, 2018 – Jan 10, 2020) Zoomed Out

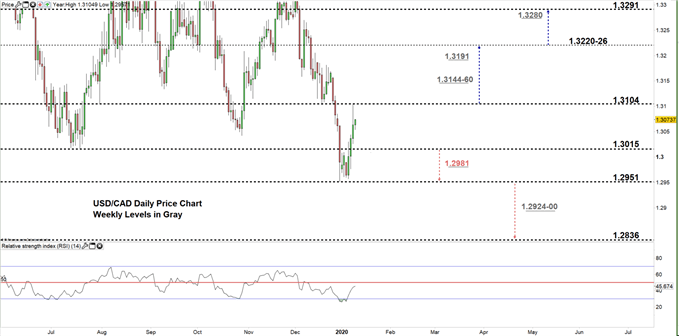

USD/CAD DAILY PRICE CHART (JuLY 17– Jan 10, 2020) Zoomed In

From the daily chart, we notice on Wednesday USD/CAD rallied to a higher trading zone 1.3015 – 1.3104. Yesterday, the price rebounded from the high end of the zone and this led the pair to point lower eyeing a test of the low end of it.

A close blow the low end of the zone may encourage sellers to send USDCAD towards 1.2951. Further close below this level could persuade more sellers to join the market and press towards 1.2836. In that scenario, the daily and weekly support levels should be considered as some market participants might exit their trades at these points.

On the other hand, a close above the high end of the zone may lead more sellers to exit the market. This opens the door for buyers to push USDCAD towards the vicinity of 1.3220-26. That said, a special attention should be paid to the weekly resistance level and area marked on the chart.

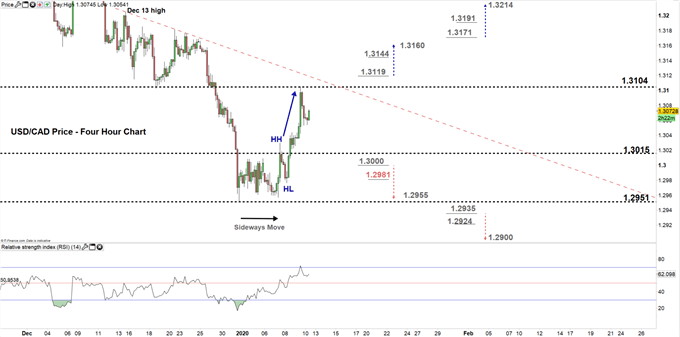

USD/CAD four hour PRICE CHART (July 17 – Jan 10, 2020)

Looking at the four- hour chart, we notice on Tuesday USD/CAD ended its sideways move and started uptrend move creating a higher high with a higher low. The price could test today the downtrend line originated from the Dec 13 high at 1.3205. Current uptrend move would likely continue if the price breaks and remains above the downtrend line.

Thus, a break above 1.3119 may cause a rally towards 1.3160. Yet, the weekly resistance level underlined on the chart should be watched closely. On the flip side, a break below 1.3000 handle could lead USDCAD towards 1.2955. Although, the daily support level underscored on the chart should be kept in focus.

See the chart to know more about key levels to monitor in a further bullish/bearish move.

Having trouble with your trading strategy? Here’s the #1 Mistake That Traders Make

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi