Canadian Dollar Talking Points:

- USD/CAD Price Forecast: downside favored on close below 1.2490 (50% of Sept.-Oct. range)

- Employment data from US & CA likely to drive trend over coming week

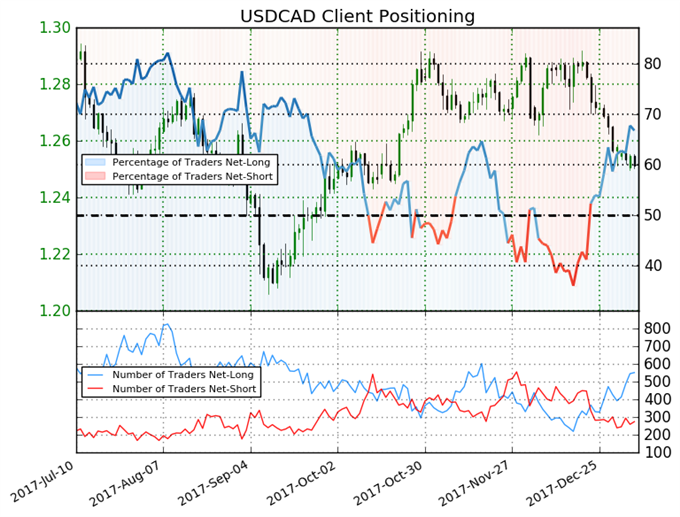

- Sentiment Highlight: net-bullish bias in retail positioning provides ST bearish outlook

After seven straight daily declines, which started on December 26, USD/CAD is losing its bearish momentum. At the same time the bearish momentum is waning, USD/CAD technical studies are showing multiple levels of support.

Rebound Losing Steam

The price of USD/CAD bounced aggressively off 1.2062 in early September to 1.2917 in late October. 1.2917 proved to be a tough level to break as the price attempted to break above at the end of November and twice in December to no avail before retracing. The end of December was a particularly impressive route as the seven straight daily declines took the price down to 1.25, which is the 50% retracement of the September-October range.

Unlock our Q1 forecast to learn what will drive trends for the US Dollar at the open of 2018!

Institutional Positioning & Yield Spreads

From an institutional speculative positioning perspective, CAD longs cooled off. Traders may be paring longs in anticipation of a power pack of fundamental data that includes US & CA employment data.

Two other supplements to my view of USD/CAD is institutional positioning and the US/CA 2-Year rate spread. The spread has done a fair job of determining the price action of USD/CAD, and a recent rebound in rate hike expectations by the Bank of Canada helped provide an unwind of short positions for the Loonie. The current spread between US minus CA 2-year yields is ~25bps. Should the spread manage to widen beyond 35bps in favor of the US, traders would likely see a breakout higher in USD/CAD develop back toward 1.30.

Another potential development for the bulls came from positioning. The net speculative positioning by institutions also pared their long CAD trades in the final week of 2017 as the net long position fell ~62% from ~45,800 net long futures contracts by 28,555 contracts to 17,346 net long contracts.

USD/CAD Chart: Pushing Down Into Key Support

Chart created by Tyler Yell, CMT. Tweet @ForexYell for comments, questions

The breakout level that could indicate the amount of selling was overdone and a USD rally is on its way would be a break above 1.2650, the 9-day midpoint per Ichimoku and a break above 1.2710 (26-day midpoint) would indicate the September-October move higher is set to resume. Should the price find a ceiling of resistance in the 1.2650/2710 range Only a breakdown below 1.2650 on a closing basis for USD/CAD would adjust the bullish forecast.

Valuable Insight from IG Client Positioning for USD/CAD

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bearish contrarian trading bias.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell