To receive Tyler’s analysis directly via email, please SIGN UP HERE

- USD/CAD Technical Strategy: strong resistance at 1.2778, awaiting sell opportunities

- Option activity showing highest premium for protection against further CAD losses

- Sentiment Highlight: absolute bullish retail bias on USD/CAD favors downside

The Canadian Dollar has traded to seven-week lows, and insight from the options market ahead of the Bank of Canada meeting may show the selling will continue.

The rising USD/CAD is lining up with a market expecting a more hawkish-then-Yellen Fed chair to be shortly named by US President Trump while the BoC looks to be playing defense. After a mid-year transformation to a tightening central bank, the Bank of Canada has recently called themselves unwilling to ‘hike blindly’ and remain ‘data-dependent.’ Almost on cue, Canadian economic data and expectations for future BoC hikes have begun to falter.

The odds of an October 25 hike by the BoC have fallen from 55% in mid-September to 17% and are heading lower. Similarly, the odds of some additional form of BoC tightening has fallen from 80% in early September to 41% as of October 23, and a failure to hike, plus a recognition of weakening CA data could pull the odds and the conversion rate of CAD down further.

The technical outlook is focusing on further rises against the broader downtrend that began in early May. Given the weakness of the Canadian Dollar, strength would need to develop that takes USD/CAD below the October low (1.2433) before expectations of CAD momentum are well founded. Until then, traders should keep an eye on daily closes above the 1.2433 area to favor a march toward 1.2723-78 zone (38.2% retracement of May-Sept. range, Aug 15 high.)

Unlock our Q4 forecast to learn what will drive trends for the US Dollar through year-end!

Chart created by Tyler Yell, CMT. Tweet @ForexYell for comments, questions

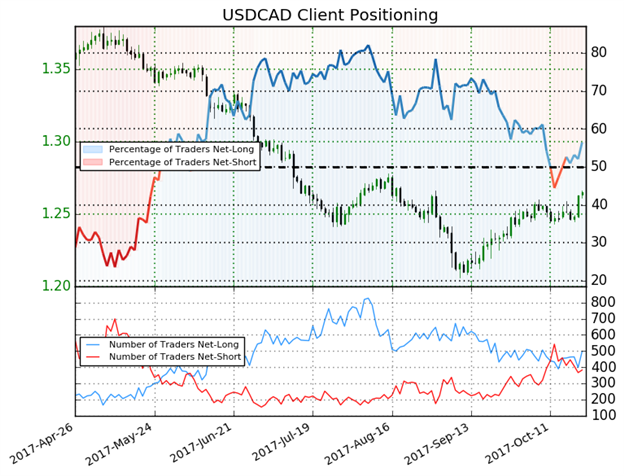

USD/CAD Insight from IG Client Positioning: absolute bullish retail bias on USD/CAD favors downside

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

USDCAD: Retail trader data shows 56.5% of traders are net-long with the ratio of traders long to short at 1.3 to 1. The number of traders net-long is 13.7% higher than yesterday and 18.6% higher from last week, while the number of traders net-short is 4.1% higher than yesterday and 18.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bearish contrarian trading bias (emphasis added.)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell