To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

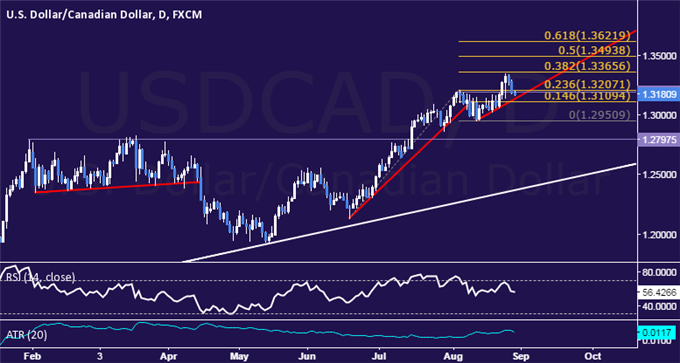

- USD/CAD Technical Strategy: Long at 1.3247

- US Dollar Back on the Defensive as Prices Recoil from Resistance

- Long Position Begrudgingly Left Open, Awaiting Further Clarity

The US Dollar turned lower against its Canadian namesake after prices found resistance above the 1.33 figure. The move lower narrowly breached the 23.6% Fibonacci expansion at 1.3207, meeting the condition we set out for triggering the stop-loss on our long trade from 1.3247. However, after much consideration, we will opt to keep the trade in play and revise its parameters.

We generally consider failing to follow through on stop-loss parameters anathema to our trading philosophy. Excessive rigidity can sometimes prove as detrimental as a lack of discipline however, and we suspect this may be just such an instance.

Prices conspicuously fell short of finishing the day below the August 4 close, casting doubt on whether the August 24 upside breakout has been truly invalidated. Furthermore, our entry at 1.3247 and first objective at 1.3366 imply the lowest stop-loss level acceptable given a 1:1 risk/reward ratio – the minimum for our strategy – is at 1.3128. This gives us a bit of leeway to let the pair prove its bearish intentions if the upside breakout is indeed false. We will now place a hard stop at 1.3128 to force the 1:1 constraint on risk however.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!