To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

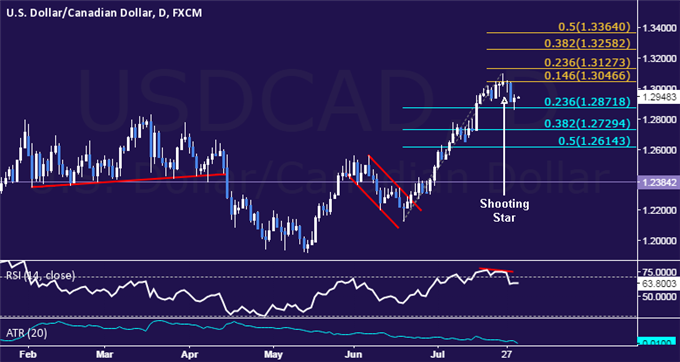

- USD/CAD Technical Strategy: Long at 1.2649

- Support: 1.2872, 1.2729, 1.2614

- Resistance: 1.3047, 1.3127, 1.3258

The US Dollar found interim support below the 1.29 figure against its Canadian namesake after correcting downward as expected. A daily close below the 23.6% Fibonacci retracementat 1.2872 exposes the 38.2% level at 1.2729. Alternatively, a move above the 14.6% Fib expansion at 1.3047 opens the door for a challenge of the 23.6% level at 1.3127.

We entered long USDCAD at 1.2649 and have since taken profit on half of the trade. The remainder of the position will remain in play to take advantage of any further on-coming gains. The stop-loss is now at the breakeven level.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com