USD Technical Outlook

- DXY hit new year high last week, in retreat mode for now

- Watch support as trend is favorable for higher prices

US Dollar Technical Outlook: DXY Pullback May Offer Opportunity

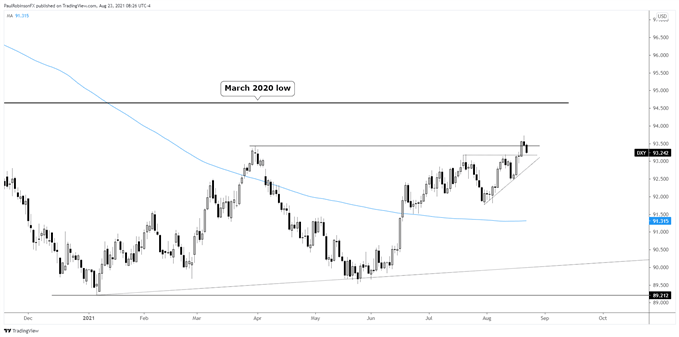

The US Dollar Index (DXY) hit a fresh yearly high last week as the trend, albeit sluggish at times, off the May low continues to be favorable for higher prices. The pullback after taking out the year high created in March could offer traders an opportunity to join the upward trend.

There is support at the 93.19 level, the top an ascending wedge formation. This is viewed as the first level to look for the DXY to solidify and try and turn back up. If price falls back inside the wedge risk will start to increase that a larger reversal is underway, but the underside line of the pattern near 92.85 will need to break first to validate that scenario. This will be viewed as a line-in-the-sand for a long/short bias.

With that in mind, looking to enter at either support level provides would-be longs with a backstop to use to assess risk. The latter level being the most critical.

Should support hold and the USD turns back higher, there is room to run. The next major level of resistance doesn’t arrive until around 94.65. This level was a low created during the initial days of the pandemic and was later validated in September as a meaningful level when it acted as resistance.

This provides for a decent amount of room to run higher. For those looking for a swing trade this leaves a decent chunk left before the trend may run out of steam, and for those shorter-term players the trading bias will be to the upside as long as higher highs, higher lows continue to develop.

US Dollar Index (DXY) Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX