US Dollar Index (DXY) Talking Points:

- The ONE Thing: Trump’s comments stole the day as he took the unusual track of commenting directly on monetary policy when he said, “Our currency is going up, and I have to tell you it puts us at a disadvantage.” Thisis seen in the light of the trade war where he said the Chinese currency is ‘dropping like a rock.’ After the comments hit headlines, the White House said that Trump "respects independence of Fed.”

- Yen jumps most in a month before trading at 113 rising 0.61%. Canadian Dollar is the only currency in G10 at time of writing lower on the day vs. USD after Trump’s comments. CHF also jumped taking USD/CHF down 0.5%.

- Technical Outlook on the US Dollar: The bears in the US Dollar Index (DXY) have few legs to stand on while bullish arguments continue to compile. Whether looking through the lens of Ichimoku, Elliott Wave, Andrew’s Pitchfork, or MACD (there are more) the prudent approach seems to favor further US Dollar Index gains.

Trump Takes On the Fed

The Dollar dived after comments from US President Trump where he said he’s not thrilled about interest rate hikes through remains firmly in the driver’s seat against the G10. It’s hard to call the JPY strong against the USD above 110 in the current environment.

A key tenet of the Federal Reserve is their independence from executive office or overt political interference. While Trump’s comments have little precedent, it’s also unlikely that it will sway the Fed. We just heard from Fed Chairman Jerome Powell at the Humphry Hawkins semi-annual testimony where he emphatically emphasized that the Fed was wholly independent and that fiscal policy and the governmental plans.

To be fair, China’s currency is weakening aggressively with USD/CNY having risen by more than 8% since the April lows. Put another way; China is using the Yuan as a policy tool to act as a rudder to help them better steer the economy through this storm of Trade Wars.

Unlock our Q3 forecast to learn what will drive trends for the US Dollar through 2018!

Technically Speaking – US Dollar Meets Firm Resistance At 95

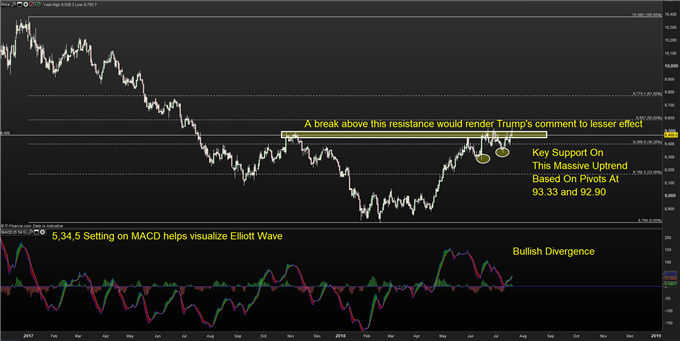

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

Looking at the chart above, traders can see that the US Dollar Index has now met considerable resistance at 95. A shortcut I like to use in analysis is to identify an extreme day and draw that day’s range as resistance. The October 27 high of 94.929 and low of 94.50 have together brought considerable resistance to the US Dollar Index.

However, the US Dollar index is trading at higher lows for June & July. A break above this zone would favor a move toward the 61.8% retracement of the 2017-2018 range at 97.74. On the contrary, a break below the recent higher lows at 93.33 and 92.90 would mark the possibility of a larger pullback.

Until then, it’s likely time to pull back or at least discount the hyperbole on the US Dollar’s reaction about the Fed now bowing to Executive Office pressure.

New to FX trading? No worries, we created this guide just for you.

MORE SUPPORT FOR YOUR TRADING:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q3 have a section for each major currency, and we also offer an excess of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our popular and free IG Client Sentiment Indicator.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell