US Dollar Index (DXY) Talking Points:

- The ONE Thing: the US Dollar is taking no prisoners. In mid-April, the aggregate US Dollar short position was at a seven-year high. Since April 17, futures have continued to pare USD short exposure, which continues to lift US Dollar on a short covering rally.

- The focus has been spread out as the US Dollar advances from EUR/USD breaking below the 55-WMA to Emerging Markets that are stronger in aggregate, but still vulnerable in parts. Lastly, the British Pound just broke below a key trendline that could precede a move below $1.3000 per GBP while the JPY is looking comfortable at the highest levels since mid-January.

The march higher in US Yields has been doing much of the heavy lifting for the US Dollar. The question now is what will stop the ever-rising yields?

The onslaught of supply at Treasury auctions and stable US economic data combined with rising commodities (namely, energy) seem to speak to an environment ripe for rising yields, and thus, a rising US Dollar.

Traders are often quick to identify a theme and then identify winners and losers within the theme. Currently, ‘risky’ currencies appear ripe for losses as US yields lead to tighter financial conditions.

‘Risky’ currencies as an asset class are typically categorized as Emerging Markets FX or EMFX. As a group, EMFX posted its biggest weekly drop since November 2016 last week as local-currency bond markets fell for the sixth straight week.

If you’ve heard the phrase, ‘don’t catch a falling knife’ as a moniker of not buying something in a falling environment, the ‘risky’ currencies appear to fit that bill.

Unlock our Q2 forecast to learn what will drive trends for the US Dollar through 2018!

Positioning Supports USD

There has been a shift since mid-April in favor of long USD positioning among short-term or leveraged investors in recent weeks, and questions remain as to whether real money buyers will also get behind US Dollar strength. Real Money has staying power and can help put in a higher floor behind a market.

The increase in bullish USD positioning has come mostly against European currencies. EUR net longs have fallen $6bn ($23.4bn to $17.0bn) since April 20 release or on April 17 data ($0.8bn this week.) GBP net longs have decreased by $4bn ($0.3bn this week.) CHF net shorts have increased by $3bn ($0.5bn this week.)

Meanwhile, AUD accounted for $0.9bn of this increase over the last month. Bearish AUD positioning increased by $0.5bn this week.

Technically Speaking

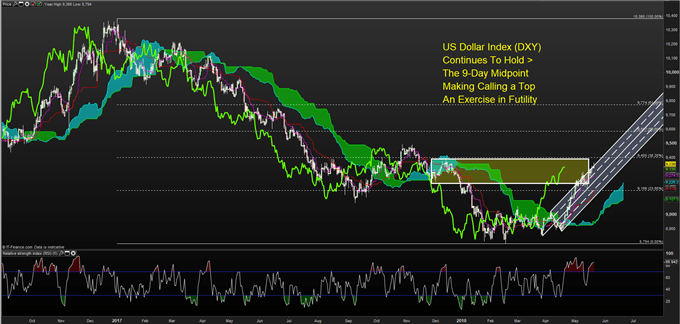

Traders are likely wary of a stall in the US Dollar index given its sharp ascent. The market continues to trade above the 9- and the 26-day midpoint at 92.74 and 91.76 respectively, which tends to act as strong support with the Ichimoku lagging line well above price from 26-periods ago showing strong momentum.

Not familiar with Ichimoku? You’re not alone and in luck. I created a free guide for you here

RSI(5) may be overbought, but that’s an uptrend for you. From a momentum perspective, traders likely want to be aware of whether or not RSI(5) begins to establish a higher-low.

Initial resistance comes in at 94, the 38.2% retracement followed by 94.94, the October/ November high.

DXY Continues To Trade Strong Above Ichimoku Support

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

Recommended Reading: 4 Effective Trading Indicators Every Trader Should Know

New to FX trading? No worries, we created this guide just for you.

More For You:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q2 have a section for each major currency, and we also offer an excess of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our popular and free IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a surplus of helpful trading tools, indicators, and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions.

Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities, and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell