US Dollar Index (DXY) Talking Points:

- The ONE Thing: Say what you will about the US Dollar rally since mid-April, much of the move has happened on the back of EUR weakness and this week marked the most extensive EUR decline of 2018 as the economic picture got worse and the taper fears of the ECB took a cold shower.

- US Dollar Index Technical Analysis: Despite a short-term pullback, DXY upside remains favored as the weakening EUR/USD picture is supporting a potential move to 1.16/15 area or 50% of the 2017/2018 price range.

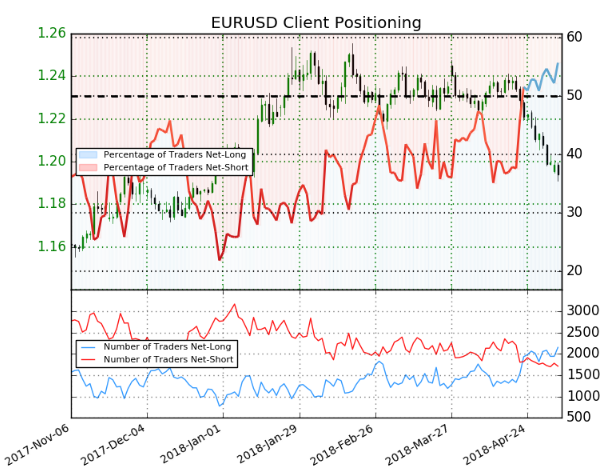

- Trader Sentiment Highlight from IG UK: Sharp rise in net-long positions favors further EUR/USD (57.6% of DXY) downside. The sentiment pictureis utilized as a contrarian technical trading tool, which derives insight from our Traits of Successful Traders research

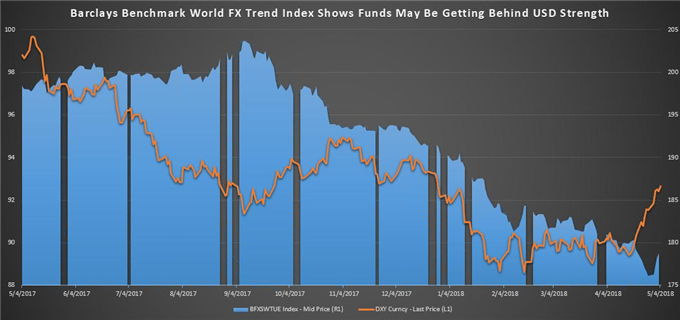

Later today, CFTC data will be released to help traders understand what type of capitulation (forced/panic selling) on the US Dollar has developed over the last week. What’s more important, will be to see how aggressively long leveraged funds may still be on the US Dollar short trade.

If funds remain net long, which they likely are, there could be further upside to the US Dollar.

Barclays Benchmark World FX Trend Excess Return May Support USD

Data source: Barclays, Bloomberg

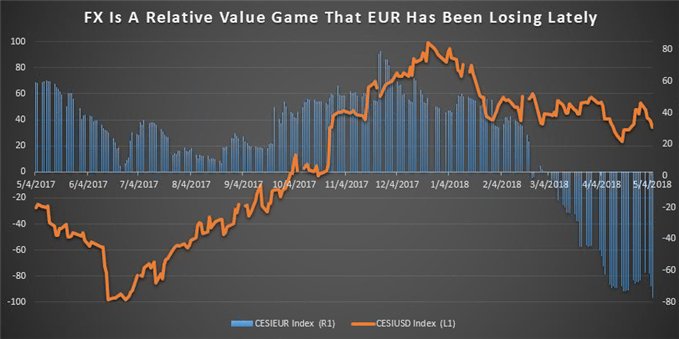

This week also saw an FOMC that seems to show a stoic Federal Reserve who will let inflation do what inflation is going to do as they march toward their pre-determined hiking path. Even though that may seem a dovish outcome, the weakening EU data has put the forward market discounting ECB tightening action that recently drove EUR higher while anticipating a Fed staying the course. A look at the Citi Economic Surprise Index seems to paint the picture well.

Relative EUR Weakness Likely To Further Support US Dollar

Data source: Citi, Bloomberg

Technical Focus on US Dollar Index: New YTD Highs Backed by Move > 200-DMA, 9-Day Mid

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

Unlock our Q2 forecast to learn what will drive trends for the US Dollar through 2018!

The US Dollar Index pushed above the 200-DMA at 91.43 and moved to 2018 highs at 92.52 on Friday morning despite a soft, but still supportive Non-Farm Payroll release.

The move higher should be looked alongside EUR/USD also dropping to a new YTD low of 1.1911 with room for a move to 1.15/16. Given the EUR weight of the DXY, that would likely favor a move higher in the DXY toward 94/95.

The bullish view for the US Dollar will remain in favor above the Ichimoku component, Tenkan-sen or 9-day midpoint at 91.50 that also aligns with the 200-DMA. Only a breakdown below the 26-day midpoint or Kijun-sen on the daily chart at 90.66 would argue that the US Dollar short traders are back with a vengeance.

Not familiar with Ichimoku? You’re not alone and in luck. I created a free guide for you here

For now, it looks like the global cost of a US Dollar is going to remain on a steep slope higher.

Recommended Reading: 4 Effective Trading Indicators Every Trader Should Know

Insight from IG Client Positioning: Traders are betting the EUR has bottomed, but that may be an expensive play.

EUR/USD sentiment is analyzed for insight since EUR/USD makes up 57.6% of the DXY basket.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias (emphasis mine.)

New to FX trading? No worries, we created this guide just for you.

TO READ MORE:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q2 have a section for each major currency, and we also offer an excess of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our popular and free IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a surplus of helpful trading tools, indicators, and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions.

Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities, and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell