Want to learn how to trade from our experts? We recently updated and added new trading guides here.

Talking Points:

- DXY Technical Strategy: DXY remains in “sell the rips” mode below 95.47

- DXY polarity point of 96.50 remains technical line in the sand, bearish below

- Dollar short covering after July NFP dissipates as JPY strength becomes new focus

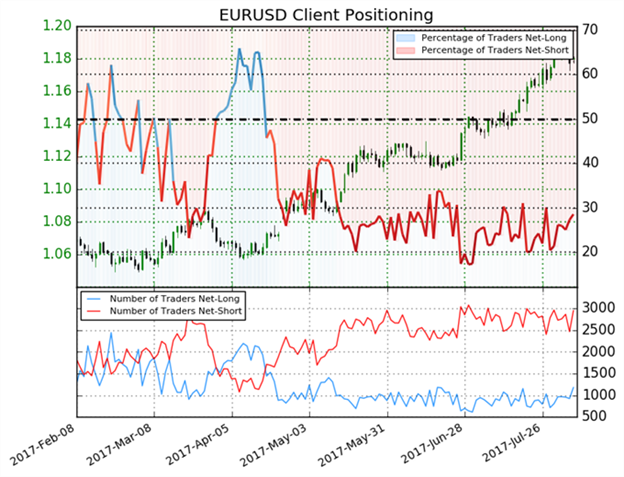

- IG Client Sentiment Highlight: EUR (57.6% of DXY) sentiment stalls – next move key

The downward momentum for the US Dollar has wobbled but overall remains on a course that anticipates further weakness. From a fundamental perspective, we heard recently from Federal Reserve Bank of New York President Bill Dudley who said that it would take some time for US inflation to rise to 2%, especially on a year-on-year basis. While he blamed the effect on one-offs from months that will take a while to fall out of the year-on-year readings, there appears to be little reason to anticipate the Fed would turn to a surprisingly hawkish stance that would lift the USD out of its 2017 downtrend.

See the markets as we do with our new and updated FREE trading guides

Last month, the key focus of USD weakness was EUR and commodity currency strength, which took EUR/USD above 1.19 and USD/CAD below 1.25. In August, so far, it appears that the Japanese Yen is the focal currency, which has recently traded toward 109 and is close to the lowest level since mid-June of 109.27. A break below 108.13, YTD low of USD/JPY, would argue that the common denominator of larger moves in FX this year has been a rather weak USD, which show few credible signs of turning.

When looking at charts across the board, it does not appear that USD is the blind sell that it once was due to emerging weakness in NZD, GBP, & CHF. However, when stronger currencies emerge, the US dollar appears little resistance for further gains.

Looking at the chart below, you can see that the price of the US Dollar Index remains in a strong downtrend. The price continues to run down the bottom half of the price channel with current resistance near 94.08, which is last August’s low as well as the opening price for the week of the Brexit vote in late June ’16. On the chart below, you can see that Dollar Bulls fail to hold their positions as shown by the upside wicks and closes near the day’s low. Only a close above 94.08 would turn the current trading bias from bearish to neutral.

If you would be interested in seeing how retail traders’ are bettingin key markets, see IG Client Sentiment here !

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss this market.

DXY below 96.50 keeps thefocus on downside extension targets @ 92.03, EUR/USD >1.16

Chart Created by Tyler Yell, CMT

IG Client Sentiment Highlight: EUR (57.6% of DXY) Sentiment Stalls – Next Move Key

EURUSD: Retail trader data shows 28.6% of traders are net-long with the ratio of traders short to long at 2.5 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.06524; theprice has moved 10.6% higher since then. The number of traders net-long is 16.3% higher than yesterday and 22.9% higher from last week, while the number of traders net-short is 16.4% higher than yesterday and 0.9% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias. (Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell