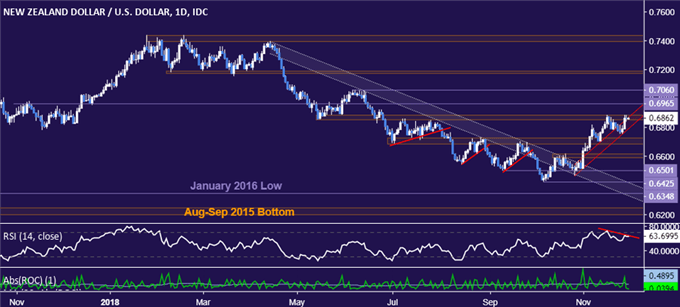

NZD/USD Technical Strategy: 0.6785

- New Zealand Dollar bounce cut short at familiar resistance level

- RSI divergence suggests that a double top may be in in the works

- Short position remains in play absent clear bullish invalidation

See our free trading guide to help build confidence in your NZD/USD trading strategy !

The New Zealand Dollar has returned to challenge resistance in the 0.6851-84 area after a foray to the downside was cut short below the 0.68 figure. A nominally higher high has been set but confirmation of a break on a daily closing basis is conspicuously absent (at least for now) and negative RSI divergence warns of ebbing upside momentum.

A reversal downward from here sees initial trend line support at 0.6795, with a break below making a compelling argument for downtrend resumption and opening the door for a test of the 0.6688-0.6726 zone. Alternatively, a daily close above 0.6884 eyes a minor chart inflection point barrier at 0.6965, followed by a more substantive threshold at 0.7060 (June 6 high).

The short NZD/USD trade triggered at 0.6785 remains in play. While lasting downside follow-through is yet to materialize, the bearish pattern at the heart of the setup has not been overturned. With that in mind, it seems prudent to give the position a bit of room to develop and establish clearly whether a secondary top will lead to reversal or if definitive invalidation will open the door for gains.

NZD/USD TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the Comments section below or @IlyaSpivak on Twitter