To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

- Kiwi Dollar H&S pattern unravels but bearish trend bias may still be intact

- Re-established short position looks for prices to test below 0.72 figure again

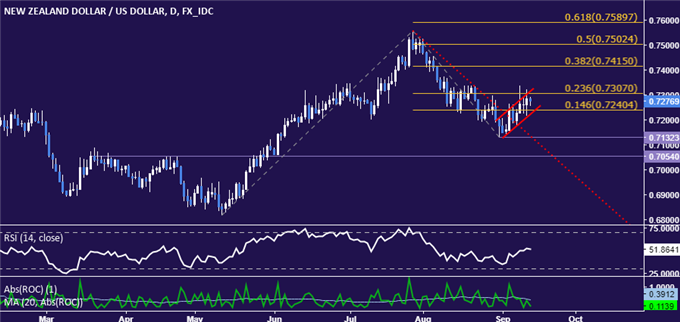

The New Zealand Dollar has seemingly invalidated a bearish Head and Shoulders chart formation against its US namesake but scope for recovery may be limited. Polling data ahead of the general election on September 23 pushed prices higher but gains might prove corrective in the context of a longer-term decline.

Sizing up current positioning, a daily close above the 23.6% Fibonacci expansion at 0.7307 opens the door for a test of the 38.2% level at 0.7415. Alternatively, a reversal back below the 14.6% Fib at 0.7240 paves the way for another challenge of the August 31 low at 0.7132.

The short NZD/USD trade from 0.7230 has been stopped out. The tepid move higher from the August 31 low may yet amount to a bearish Flag pattern preceding continuation of the decline from the July 27 swing top. Confirmation is absent for now however, arguing against re-entering short at this time.

Want to learn how to trade economic news driving FX markets, including NZD/USD? See our guide !