To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

- New Zealand Dollar eyes double top above 0.70 figure vs. US namesake

- Upcoming RBNZ monetary policy announcement may alter positioning

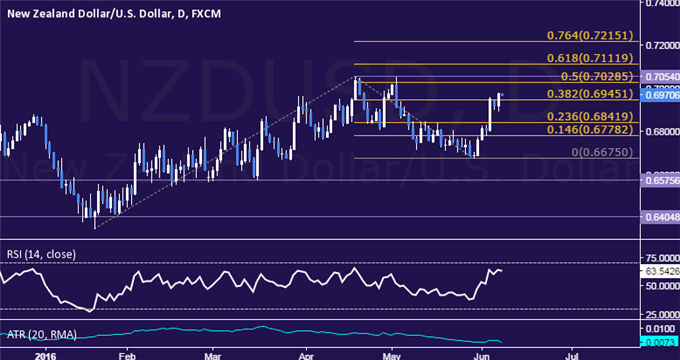

The New Zealand Dollar looks poised to challenge a familiar double top above the 0.70 against its US counterpart having renewed upside momentum after a brief pause. Upside follow-through may be undermined by the approaching RBNZ monetary policy announcement, however.

A daily close above the 0.7029-54 area, marked by the 50% Fibonacci expansion and the April 19 high, paves the way for a test of the 61.8% level at 0.7112. Alternatively, a reversal back below the 38.2% Fib at 0.6945 sees the next downside barrier at 0.6842, the 23.6% expansion.

The dominant long-term NZD/USD trend appears to favor a downside bias. However, the absence of a defined bearish reversal signal and approaching RBNZ event risk argues against pulling the trigger on a short position at current levels. With that in mind, remaining flat seems prudent.

Track short-term NZD/USD chart patterns with the DailyFX GSI Indicator !