To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- NZD/USD Technical Strategy: Flat

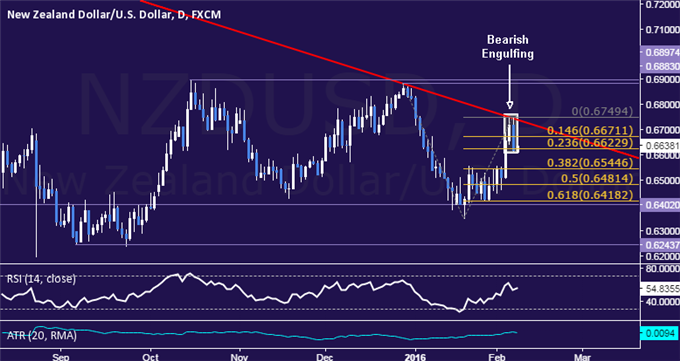

- New Zealand Dollar turns lower after testing 19-month trend line resistance

- Waiting to enter short until positioning offers favorable risk/reward setup

The New Zealand Dollar recoiled from resistance capping gains against its US namesake since early July 2014, producing the largest one-day drop in five months. The formation of a Bearish Engulfing candlestick pattern hints at continued weakness from here.

Near-term support is at 0.6545, the 38.2% Fibonacci expansion, with a break below that on a daily closing basis opening the door for a challenge of the 50% level at 0.6481. Alternatively, a reversal above the 23.6% Fib at 0.6623 clears the way for a test of the 14.6% expansion at 0.6671.

The available trading range is too narrow to justify taking a trade at current levels from a risk/reward perspective. With that in mind, we will stand aside for now and wait for an opportunity to enter short in lie with the long-term NZD/USD down trend.

Losing money trading NZD/USD? This might be why.