To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

- GBP/JPY Technical Strategy: Flat

- GBP/JPY put in a 2,400 pip move lower, and has since retraced 1,000 pips. This is a very volatile market, especially right now.

- GBP/JPY is traditionally very volatile, but with huge fundamental issues for both represented economies, this pair can put in significant movement in the coming weeks. Make sure your risk management has been addressed before dabbling with ‘The Dragon.’

GBP/JPY has a few nicknames of note, one being ‘The Dragon,’ and the other being ‘The Widow-maker.’ Both nicknames denote the penchant for volatility that will often be found in this pair, and the past two months have been nothing short of astounding, even in GBP/JPY terms. From the beginning of December to mid-January we saw GBP/JPY rip off 2,400 pips to the down-side; and then after support came in around the middle of January, we’ve seen the pair move higher by more than 1,000 pips; and this can still be classified as a ‘retracement.’

With Japan having recently moved into ‘negative rates’ territory combined with the growing sentiment around an increased possibility of a Brexit, and with a Bank of England meeting on the docket for this Thursday, the potential for heightened volatility remains. And in GBP/JPY, that means any trader taking a position should take notice.

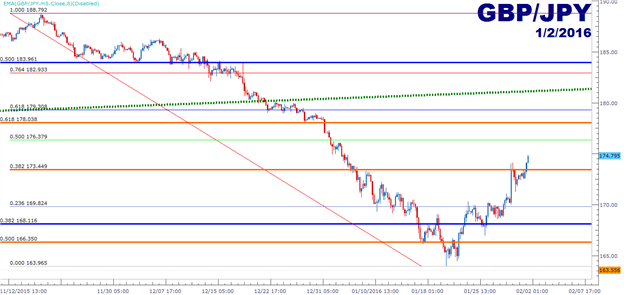

In the near-term, the top-side momentum is notable. We’ve basically seen 500 pips of run since Thursday’s close. That’s not something you want to directly fade unless you have a really strong resistance level to trade it off of, which I don’t. Not yet anyways. There’s a major psychological level at 175, a 50% Fibonacci retracement of the most recent major move at 176.37, and a 61.8% Fibonacci retracement of the secondary move in the pair at 178.03 (taking the 2008 high to the 2011 low). But there hasn’t been much signs of slowdown in this move higher yet, and there are no indications of resistance setting in. So, traders that are looking to get short GBP/JPY would likely want to wait for that resistance to develop in one of those price zones, and this can be found by looking for top-side wicks on the hourly or four-hour charts.

On the top-side, we’ve seen intra-day support develop in the 173.50-vicinity, which was also a previous swing-high. The 38.2% retracement of that most recent major move comes in right at 173.45, and traders can potentially use this as an entry level for top-side plays. Similar logic would be needed, as in traders would likely want to wait for support to develop at this price on the hourly or 4-hour charts before triggering long. This could open the door for targets at 176.37 and then 178.03. If we can break above 178, which in GBP/JPY, anything is possible, then additional targets could be cast towards 179.30 and then 180.00.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX