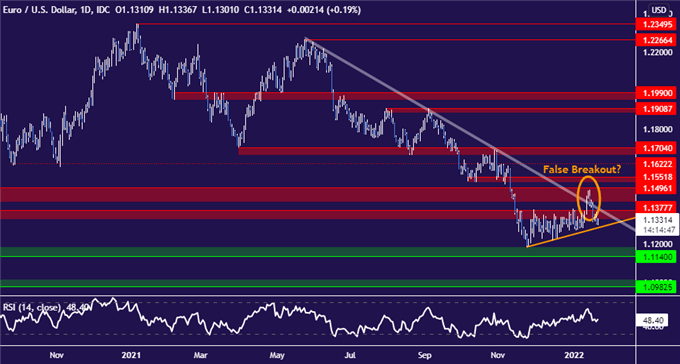

EURO, US DOLLAR, EUR/USD, TECHNICAL ANALYSIS – TALKING POINTS:

- EUR/USD break higher fails as prices slump back into familiar range

- Key counter-trend line under pressure, break may see test below 1.12

- Retail positioning data hints at stronger bearish bias now vs. last week

EUR/USD price action seems to have evolved in sellers’ favor since last week’s explosive upward break failed to find follow-through. The Euro has slumped back through the 1.1330-78 congestion area, landing it right back into the choppy range from which it appeared ready to escape.

The upward-sloping support line defining the bounds of the rise from November’s swing bottom is back under pressure. A daily close below that barrier may set the stage for extension downward to challenge the 1.1140-86 area once again. That is a region of significance dating back to March-June 2020.

Reclaiming some sense of relief is likely to demand the Euro to re-establish a firm foothold above 1.1378. That would neutralize some near-term selling pressure and perhaps pave the way for another run at key resistance clustered near the 1.15 figure.

EUR/USD daily chart created with TradingView

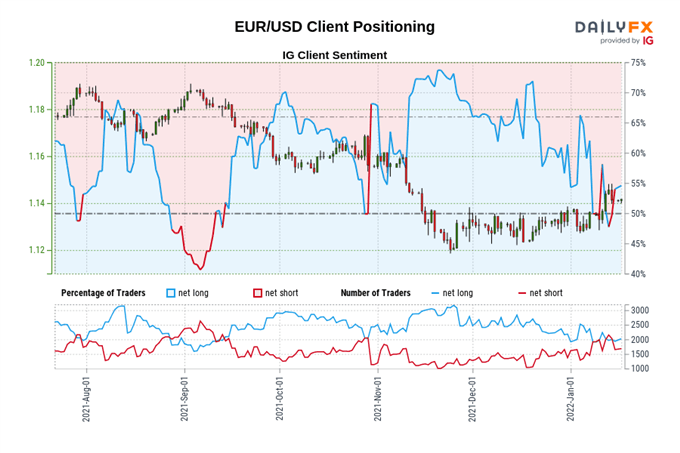

Meanwhile, retail sentiment has also shifted in a more bearish direction. Positioning has move to a 63.1 percent tilt to the long side having been almost evenly split just days ago. In fact, the net-long skew has increased by an eye-catching 22.3 percent over the past week.

This is typically considered as a contrarian indicator: a positioning pivot toward the long side is seen as suggesting that prices may be biased lower. The skew is still relatively modest at 1.7 longs for every short, hinting that there remains room for a decline to continue developing.

EURO TRADING RESOURCES

- Just getting started in the markets? See our free trading guides

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head Strategist, APAC at DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter