EUR/USD TECHNICAL ANALYSIS: NEUTRAL

- Euro extended higher after forming bullish H&S chart formation

- Negative RSI divergence now hinting at a downturn in the works

- Retail trader positioning offers mixed EUR/USD trend guidance

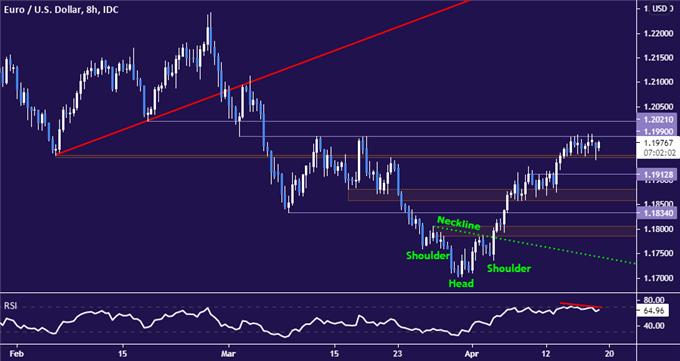

The Euro extended upward against the US Dollar after completing a bullish Head and Shoulders chart pattern, as expected. In fact, prices surpassed the pattern’s implied upside target just shy of the 1.19 figure to hover at a one-month high within a hair of the 1.20 mark.

Early signs of exhaustion now seem to have emerged as prices retest swing tops from mid-March. Price action has been confined to a narrow range and negative RSI divergence points to ebbing upward momentum, which may set the stage for a reversal to the downside.

Initial support is in the 1.1947-51 zone, with a break below that opening the door for a test of 1.1913. Breaching that barrier may violate the series of higher highs and lows carved out since the start of April, implying a trend change. Alternatively, claiming a foothold above 1.2021 likely exposes 1.21 next.

EUR/USD 8-hour chart created with TradingView

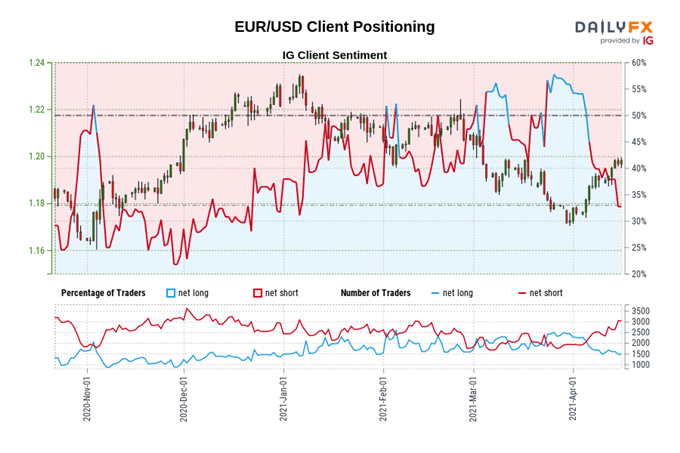

EUR/USD TRADER SENTIMENT

IG Client Sentiment (IGCS) data implies that 64.6% of market participants are net-short EUR/USD, with the short-to-long ratio at 1.83 to 1. This is typically used as a contrarian indicator, suggesting that the dominant trend bias favors gains. Positioning is less net-short than yesterday however, opening the door for realignment if follow-through materializes. Still, a greater short-side tilt versus a week ago demands patience.

See the full IGCS sentiment report here.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter