EUR/USD TECHNICAL ANALYSIS: BEARISH

- Euro upswing stalls at familiar range top near the 1.10 figure

- Near-term positioning hints a downswing may be in the cards

- Trader sentiment studies warn positioning still favors upside

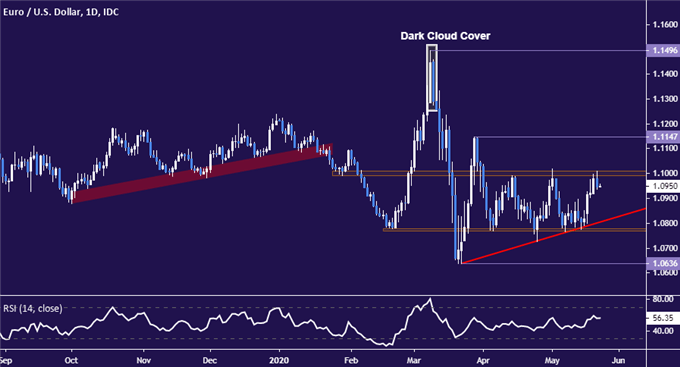

The Euro was rejected lower on a test of familiar range resistance in the 1.0992-1.1009 area, a barrier that has contained the upside for nearly two months. Extending downward from here puts the spotlight on the range floor in the 1.0768-78 zone. This threshold is reinforced by rising trend line support underpinning EUR/USD action since prices put in the year-to-date low in late March.

A retest of that bottom (1.0636) may follow if sellers manage to clear range support and confirm the breach on a daily closing basis. More broadly, such a break may suggest that the long-term downtrend started in early 2018 has resumed. Alternatively, upside resumption that cements a foothold above the range top is likely to put swing top resistance at 1.1147 into focus next.

EUR/USD daily chart created with TradingView

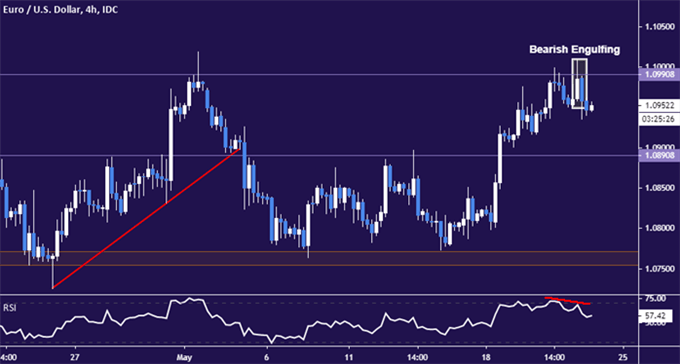

Zooming into the four-hour chart for a look at more immediate positioning seems to bolster the case for a downswing. Prices put in a dramatic-looking Bearish Engulfing candlestick pattern. Negative RSI divergence speaks to ebbing upside momentum and bolsters the case for a downside scenario. Range midline support at 1.0891 marks a potential sticking point along the way to range bottom.

EUR/USD 4-hour chart created with TradingView

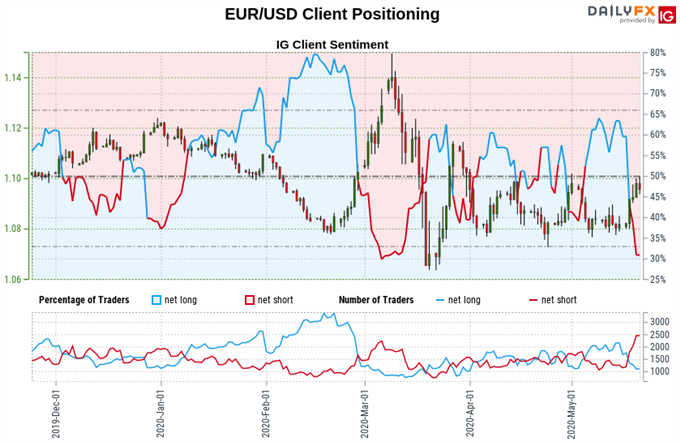

EUR/USD TRADER SENTIMENT

Retail positioning data offers would-be sellers a word of caution however. It shows that 70.25% of traders are net-short EUR/USD, with the short-to-long ratio at 2.36 to 1. IG Client Sentiment (IGCS) is typically used as a contrarian indicator, sothe skew in traders’exposure suggests the trend is biased upward.

In fact, the net-short tilt has widened recently, up 4.84 percent from yesterday and 91.46 percent compared with a week before. This seems to make for a strengthening bullish bias, although the disparity in positioning is approaching levels where extremes have tended to cluster in the past.

See the full IGCS sentiment report here.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter