EUR/USD TECHNICAL ANALYSIS: BEARISH

- Euro digesting losses at three-year lows above 1.06 figure

- Positive RSI divergence hints a rebound may be due ahead

- Trader sentiment studies send mixed EUR/USD message

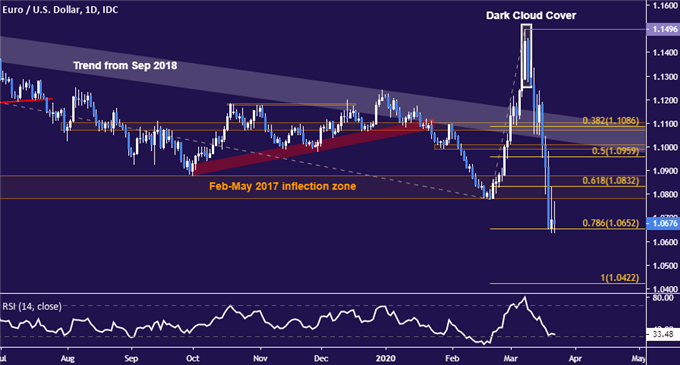

The Euro has paused to consolidate recent losses against the US Dollar having landed atop support at 1.0652, the 78.6% Fibonacci expansion. Bearish resumption from here with a break below support confirmed on a daily closing basis may clear the way to challenge the 100% level at 1.0422.

A dense block of resistance stands in the way of any would-be forays to the upside. The first hurdle of note is the 1.0783-1.0880 area, marked by a price inflection region dating back about three years. Above that, prior levels of support recast resistance run back-to-back toward the 1.12 figure.

EUR/USD daily chart created with TradingView

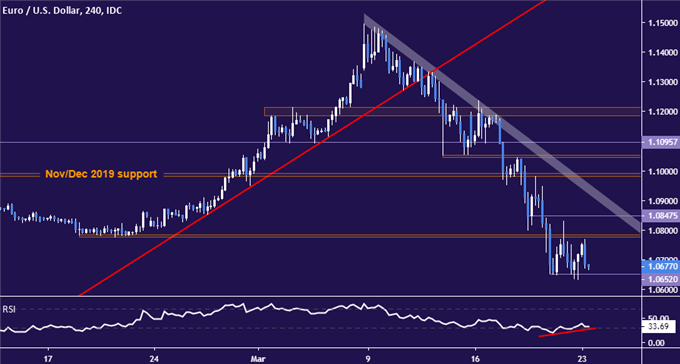

Nevertheless, zooming into the 4-hour chart suggests a bounce may be attempted all the same. The appearance of positive RSI divergence suggests downside momentum is ebbing, which may set the stage a bounce. Anything more than a correction will need to decisively clear falling trend line resistance however.

EUR/USD 4-hour chart created with TradingView

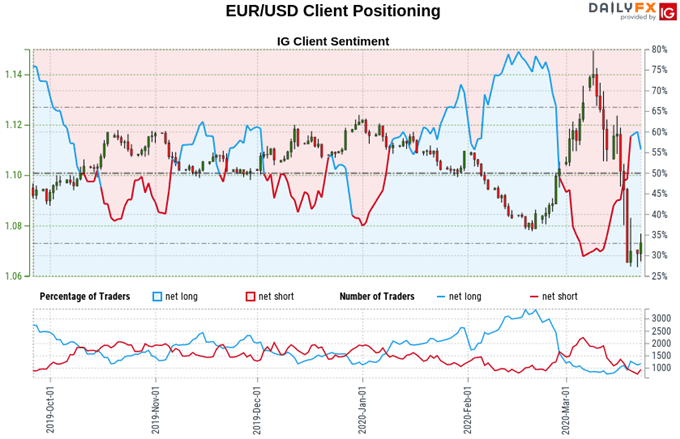

EUR/USD TRADER SENTIMENT

Retail positioning data shows 53.60% of traders are net-long, with the long-to-short ratio at 1.16 to 1. IG Client Sentiment(IGCS) is typically used as a contrarian indicator, sothe net-longskew in traders’exposure suggests that EUR/USD is likely to trade lower.

However, positioning has become less tilted to the long side compared with the prior session even as it has grown by 19.6% percent relative to a week before. These mixed messages make for a clouded sentiment-based outlook, at least for the time being.

See the full IGCS sentiment report here.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter