EUR/USD TECHNICAL ANALYSIS: BEARISH

- Euro surges to 4-month high but struggles to break range top

- Negative RSI divergence hints rally may reverse course soon

- Reversal confirmation needs break of 2-week trend support

Get help building confidence in your EUR/USD strategy with our free trading guide!

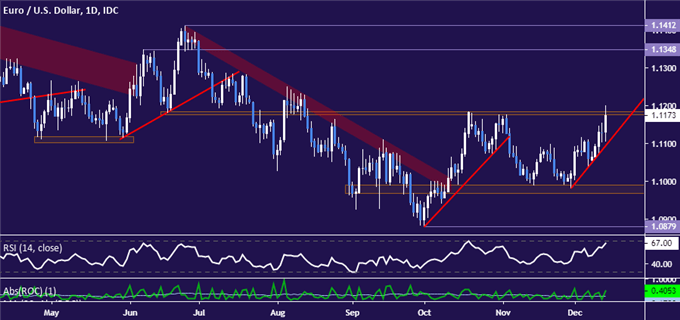

The Euro is testing the top of the range confining price action since mid-October in the 1.1176-83 area. A break higher confirmed on a daily closing basis may set the stage for a push beyond the 1.13 figure, with a minor barrier at 1.1348 lining up thereafter on route to the late June high of 1.1412.

Immediate support is marked by a rising trend line connecting swing lows defining the upswing from the October 29 low, now at 1.1094. A reversal back below that opens the door for another challenge of support in the 1.0968-90 congestion area.

Daily EUR/USD chart created with TradingView

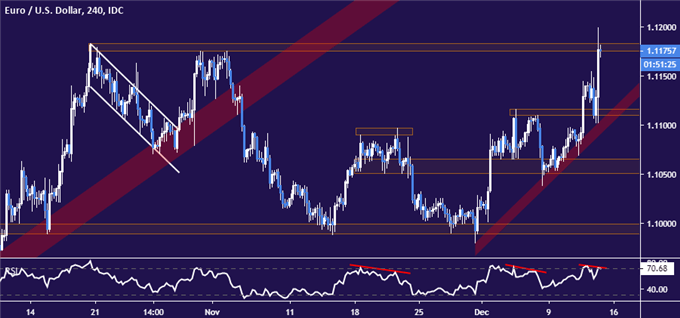

Near-term positioning suggests the upside foray may be repelled. The four-hour chart shows EUR/USD stalling at double top resistance as negative RSI divergence points to ebbing upside momentum. That might be laying the groundwork for a reversal downward.

Any weakness that follows from here will need to conclusively clear two-week uptrend support to make a convincing case for bearish follow-through, even in the near term. The long side seems no more attractive however – at least for now – as prices’ proximity to resistance speaks to adverse risk/reward parameters.

4-hour EUR/USD chart created with TradingView

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter