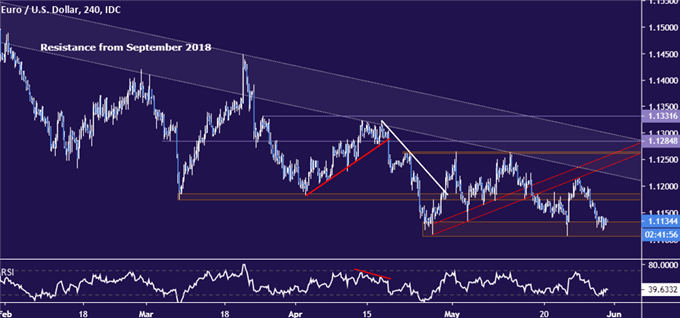

EURUSD Technical Strategy: BEARISH

- Euro back at familiar support after upswing falters at former support

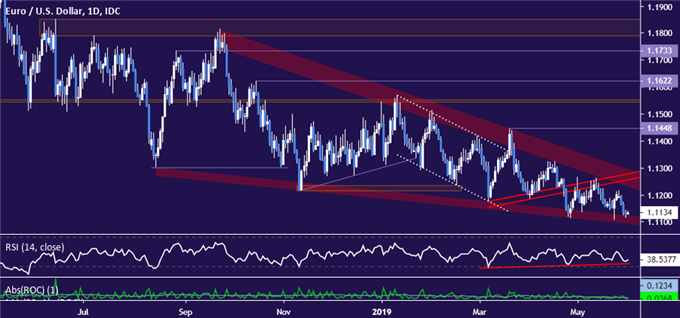

- Sellers on notice as Rising Wedge, RSI divergence warns of upswing

- Daily close above 1.13 needed to invalidate near-term bearish bias

See our free trading guide to help build confidence in your EURUSD trading strategy !

The Euro is struggling to find lasting direction cues against the US Dollar. A brief upswing faltered on a retest of countertrend line support-turned-resistance, with prices slumping back to the 1.1106-33 support zone. Still, the establishment of a lower swing high below resistance set from September 2018 implies a broadly bearish bias has been maintained (at least for now).

That is probably cold comfort for EURUSD sellers however. Prices are sitting squarely at support, making a short trade appear unattractive from a risk/reward perspective. Furthermore, the makings of Rising Wedge formation coupled with positive RSI divergence on the daily chart warns of ebbing downside momentum and hints that a reversal upward might be brewing ahead.

Confirming the Wedge setup would require a daily close above its upper boundary, now essentially at the 1.13 figure. Doing so successfully seems likely to open the door for a foray above 1.14. Wedge floor support is at 1.1093. Breaking below that may reanimate bearish enthusiasm, exposing a minor downside barrier at 1.1024 on the way lower to a more potent threshold in the 1.0778-1.0874 congestion area.

EURUSD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter