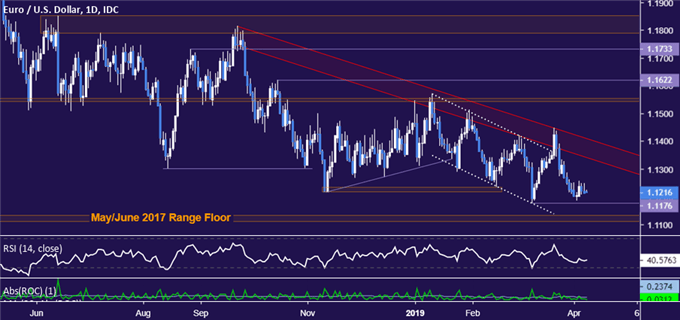

EUR/USD Technical Strategy: BEARISH

- Euro settles near one-month low after recoiling from trend resistance

- Trend bias bearish but risk/reward setup may be unattractive for shorts

- Event risk trigger may be needed to spark the next big directional move

Build confidence in your Euro trading strategy with our free guide!

The Euro has stalled near one-month support after recoiling from resistance capping upside progress against the US Dollar since late September 2018. That barrier has also established a shallow but unmistakable series of lower highs. Indeed, prices appear to be stair-stepping lower, despite a lot of chop along the way.

From here, a daily close below the March 7 low at 1.1176 opens the door for a test of the 1.1110-32 area, marked by a range floor dating back to mid-2017. Thorough invalidation of the near-term bearish bias is some way off, calling for a daily close above trend line resistance now situated at 1.1412.

Tactically speaking, this seems to broadly argue against the long side while highlighting the unattractive risk/reward setup in establishing short exposure. Directional conviction may need a fundamental jolt to rebalance the scales and revive activity. The week ahead offers ample opportunity for exactly that.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter