EUR/USD Technical Strategy: SHORT AT 1.1648

- Euro breaks monthly chart support, paving the way for deeper losses

- Near-term support just below 1.13, break to clear a path below 1.12

- Improved risk/reward setup sought to add to EUR/USD short trade

See our Euro forecast to learn what is likely drive prices in the fourth quarter!

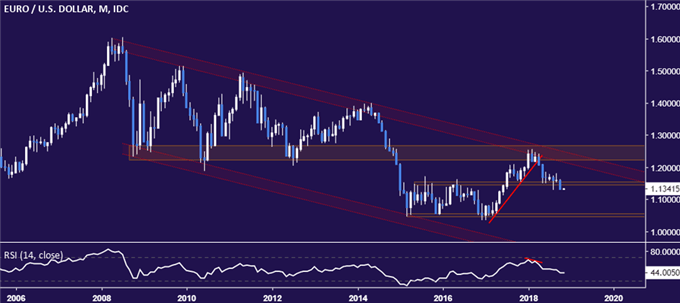

The Euro finished October with a break through range top resistance-turned-support bedeviling sellers for five months. In all, the barrier has been a pivotal long-term inflection point since May 2015. Its break portends downtrend acceleration against the US Dollar.

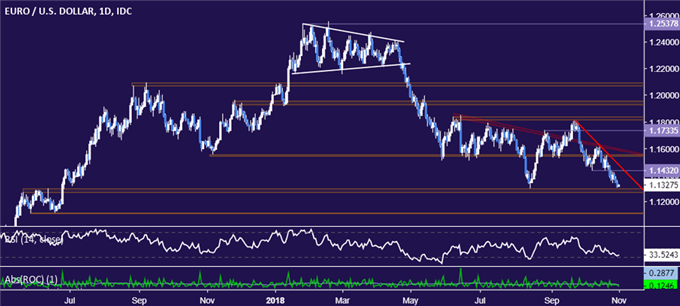

Turning to more immediate technical positioning, the daily chart shows prices sitting squarely atop support in the 1.1268-96 area. A push below this barrier confirmed on a daily closing basis opens the door for a challenge of the 1.1110-19 zone.

Initial resistance is at 1.1432, marked by the October 9 low. This is reinforced by a falling trend line defining the down move started from the late September high, now at 1.1473. A rebound that takes prices back above the latter threshold paves the way for a retest of the 1.1543-54 inflection region.

The short EUR/USD trade activated at 1.1708 and subsequently scaled up at 1.1468 continues to be in play. Prices’ perch at near-term support argues adding to exposure further on risk/reward grounds. Opportunities to do so will be evaluated on either a breakdown or a rebound toward daily chart resistance.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter