Talking Points:

- EUR/USD continues to push higher, currently above 1.1200

-Technical area around 1.1200 might need to be cleared as eyes turn to 1.13

- Further momentum could see the pair test its range highs

Learn good trading habits with the “Traits of successful traders” series

The EUR/USD continues to press higher, and managed to close above the 1.12 figure yesterday.

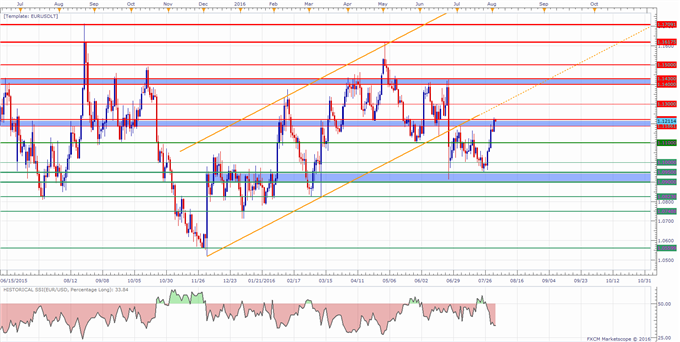

The pair has seen a bounce higher last week following a decline to the 1.0950 level, and is currently trading at a resistance zone around the 1.12 handle between 1.1220 and 1.1186.

The 1.1220 level seems to be in the way at the moment, which could imply that the pair might need to see another push higher to clear that level before eyes turn to the 1.13 handle for possible resistance.

Things get interesting around the range swing highs; initially at 1.1400-1.1430, followed by the 1.15 handle, 1.16175 and the August 2015 high at 1.1714 level. All those levels could represent major hurdles going forward for the pair.

A daily close below the 1.1186 level might be seen as a bearish signal and could put focus initially on the 1.11 handle for possible support, followed by the 1.10 figure and what seems like a key support zone below the 1.0950 level.

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing that about 33.8% of traders are long the EUR/USD at the time of writing, marking the largest short side positioning since May.

You can find more info about the DailyFX SSI indicator here.

EUR/USD Daily Chart: August 3, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

Follow him on Twitter at @OdedShimoni