To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

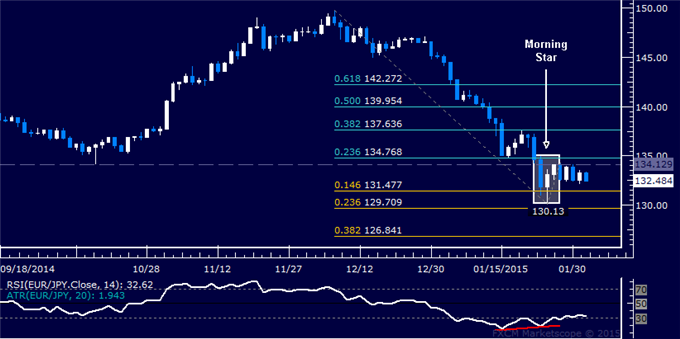

- EUR/JPY Technical Strategy: Flat

- Support: 131.48, 129.71, 126.84

- Resistance:134.77, 137.64, 139.95

The Euro may be readying to move higher against the Japanese Yen after putting in a bullish Morning Star candlestick pattern. Positive RSI divergence reinforces the case for an advance. Near-term resistance is in the 134.13-77 area, marked by the October 16 low and the 23.6% Fibonacci retracement, with a break above that on a daily closing basis exposing the 38.2% level at 137.64. Alternatively, a turn below the 14.6% Fib expansion at 131.48 clears the way for a challenge of the 23.6% threshold at 129.71.

Risk/reward considerations argue against entering long with prices in close proximity to resistance. On the other hand, the absence of a defined bearish reversal signal suggests taking up the long side is premature. We will remain flat for now, waiting for a more actionable opportunity to present itself.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

Daily Chart - Created Using FXCM Marketscope

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com