To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

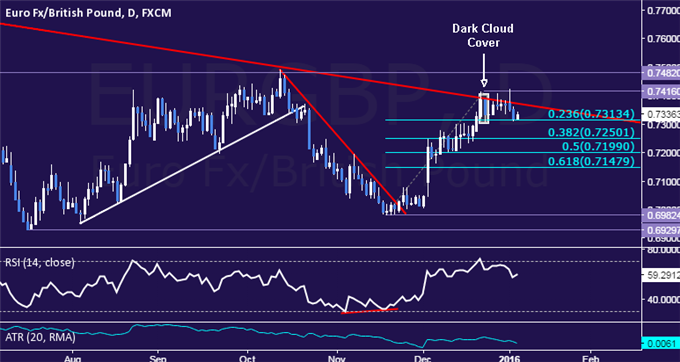

- EUR/GBP Technical Strategy: Short at 0.7382

- Euro Recoils from Trend Line Resistance, Attempts to Clear Path Below 0.73 Figure

- Profit Taken on Half of Short Position, Remainder Open with Stop-Loss at Breakeven

The Euro is attempting to build downside momentum against the British Pound after prices put in a bearish Dark Cloud Cover candlestick pattern. Sellers are attempting to clear a path below the 0.73 figure having recoiled from resistance guiding the down trend from August 2013.

A daily close below the 23.6% Fibonacci retracement at 0.7313 paves the way for a test of the 38.2% level at 0.7250. Alternatively, a reversal above trend line resistance – now at 0.7372 – opens the door for a challenge of the December 22 high at 0.7416.

Our entry order to short EUR/GBP at 0.7382 was triggered last week and prices have now hit the initial profit target at 0.7313. We have taken profit on half of the position and moved the stop-loss to the breakeven even on the remainder of the trade, leaving it active to capture any further downside momentum.

Losing Money Trading Forex? This Might Be Why.