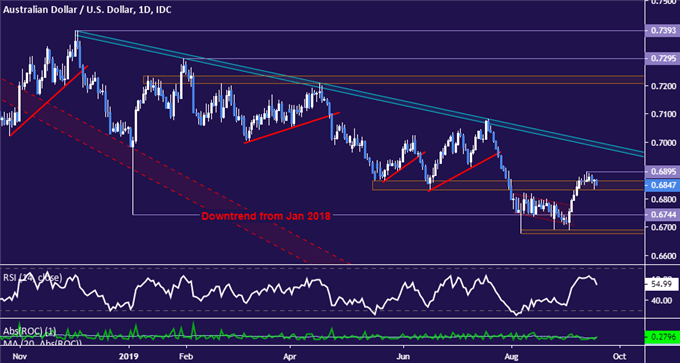

AUD/USD TECHNICAL OUTLOOK: BEARISH

- Aussie Dollar bounces, hits 6-week high vs. US counterpart

- Dominant trend still bearish, invalidation above 0.70 mark

- Near-term chart hints at possible top, confirmation needed

Get help building confidence in your AUD/USD strategy with our free trading guide!

The Australian Dollar is struggling to sustain upward momentum after probing within a hair of the 0.69 figure against its US counterpart. Prices remain above the 0.6832-65 inflection area – warning against over-extrapolating downside follow-through – but momentum has clearly ebbed relative to the pace of the spirited recovery from September lows.

Securing a break below 0.6832 on a daily closing basis would mark an important step toward identifying broader downtrend resumption and help set the stage for a retest of the monthly support shelf in the 0.6677-90 zone. The early-2019 spike low at 0.6744 may emerge as a bit of a sticking point along the way in this scenario, but it has not proven to be a particularly potent barrier thus far.

Daily AUD/USD chart created with TradingView

Still, the overall trend continues to suggest that the path of least resistance leads lower. Neutralizing near- to medium-term bearish cues would probably require a daily close above resistance capping the upside since early November 2018, now squarely at the 0.70 figure. A break above the September 12 swing high at 0.6895 is an essential prerequisite before a test of this boundary appears plausible.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter