AUD/USD Technical Strategy: Flat

- Australian Dollar two-year rising trend support has been broken

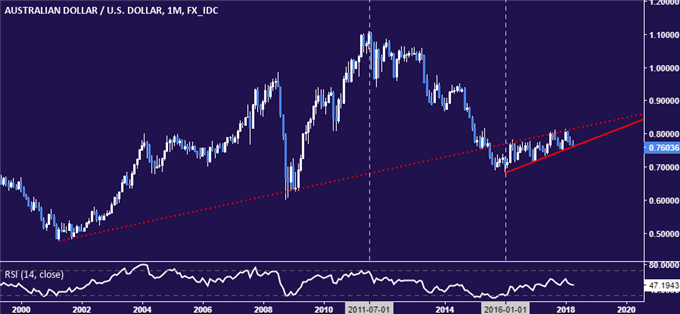

- Long-term positioning hints down trend from 2011 has returned

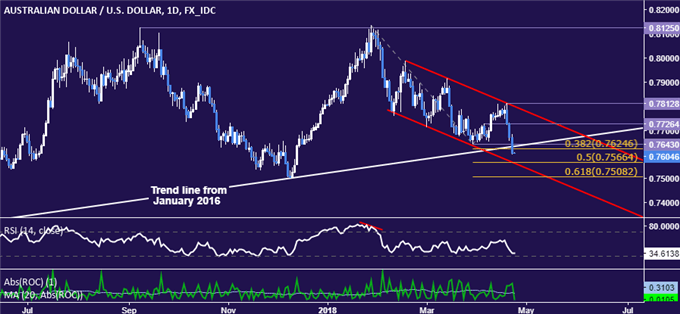

- Upswing to test above 0.76 figure sought for selling opportunity

Join our AUD/USD strategy webinar and get ready to trade the currency pair this week!

The Australian Dollar pierced support guiding the currency higher against its US counterpart since January 2016, signaling a tectonic trend change is in progress. The choppy two-year up move now looks corrective within an even longer-term structural decline started in July 2011.

From here, a daily close below support at 0.7566 (50% Fibonacci expansion, falling channel floor) opens the door for a challenge of the 61.8% level at 0.7508. Alternatively, a move back above support-turned-resistance in the 0.7625-43 area (38.2% Fib, March 29 low) sees the next upside barrier at 0.7726.

Prices are too close to immediate support to justify entering short from a risk/reward perspective. Instead, an entry order has been set up to sell the currency pair at 0.7617. If triggered, the trade will initially target 0.0.7566 and carry a stop-loss activated on a daily close above 0.7643.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter