To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

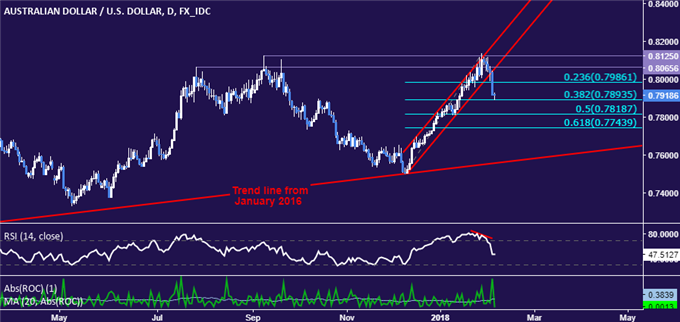

- AUD/USD Technical Strategy: Pending Short at 0.7960

- Australian Dollar suffers worst drop in 15 months, breaks near-term rising trend

- Upswing sought to trigger short position with improved risk/reward parameters

The Australian Dollar broke the rising trend in play since mid-December, hinting a top against its US counterpart has been set below the 0.82 figure as expected. The currency suffered the largest one-day drop in 15 months as upbeat US jobs data overlapped with brutal risk aversion.

Near-term support is now at 0.7894, the 38.2% Fibonacci retracement, with a break below that on a daily closing basis opening the door for a test of the 50% level at 0.7819. Alternatively, a move back above the 23.6% Fib at 0.7986 exposes resistance in the 0.8066-0.8125 area once again.

Prices are too close to near-term support to justify entering short from a risk/reward perspective. With that in mind, an entry order has been established to sell at 0.7960. If triggered, the trade will initially target a return to 0.7894 and carry a stop-loss activated on a daily close above 0.8026.

Find out here what the #1 mistake that traders make is and how you can fix it!