To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- AUD/USD Technical Strategy: Flat

- Aussie Dollar edges past near-term range floor, hinting at deeper losses ahead

- Narrow range, with looming top-tier event risk argue for against short position

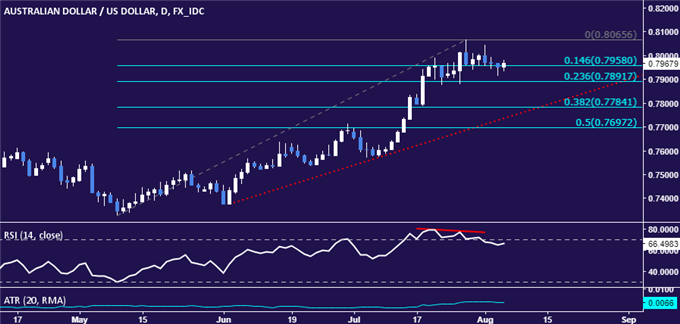

The Australian Dollar may be preparing to turn lower as expected as prices edge below near-term range support having signaled ebbing upside momentum. Confirmation of a longer-term top remains elusive however, with the series of higher highs and lows set from June still firmly intact.

From here, a daily close below the 23.6% Fibonacci retracement at 0.7892 opens the door for a challenge of the 38.2% level at 0.7784. Alternatively, a sustained advance above the 14.6% Fib at 0.7958 sees the next upside barrier at 0.8066, the July 27 high.

Tempting though it is to take a short position, opting for the sidelines seems most prudent. The near-term range is narrow and high profile event risk by way of the US jobs report can generate ample volatility that materially alters technical positioning.

Have a question about trading AUD/USD? Join a trading Q&A webinar and ask it live!