To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- AUD/USD Technical Strategy: Flat

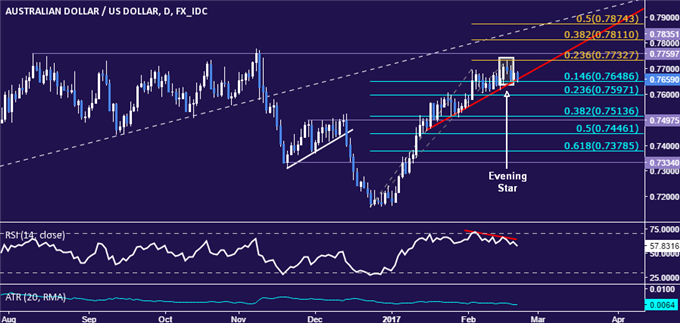

- Evening Star candlestick pattern, negative RSI divergence hints at topping

- Confirmation of reversal sought to establish actionable short trade setup

The Australian Dollarput in a bearish Evening Star candlestick pattern, hinting a top may be taking shape near double top resistance below the 0.78 figure. Negative RSI divergence warns of ebbing upside momentum and bolsters the case for a downside scenario.

From here, a daily close below the 14.6% Fibonacci retracement at 0.7649 opens the door for a challenge of the 23.6% level at 0.7597. Alternatively, a push above the aforementioned double top at 0.7760 paves the way for a test of the 38.2% Fib expansion at 0.7811.

Compelling confirmation of a bearish reversal is absent for now while near-term series of higher highs and lows set from mid-January remains unbroken. With that in mind, opting to remain on the sidelines until a more actionable selling opportunity emerges seems prudent.

Join the AUD/USD outlook webinar LIVE to see what drives prices each week!