Talking Points:

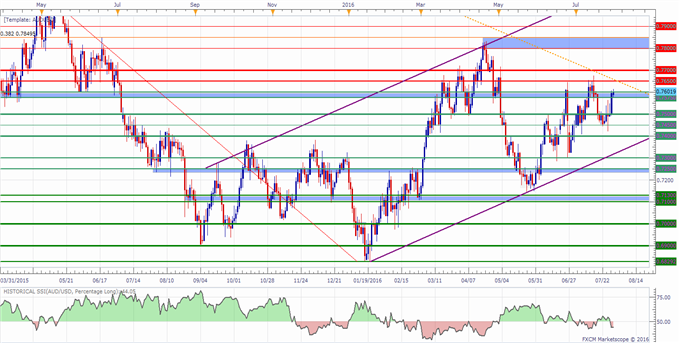

- AUD/USD found support below the 0.7450 figure

-Further upside conviction might need to see a break above resistance at 0.7650

- 0.7500 could be in focus on a move lower

The AUD/USD is trading higher after Friday’s US GDP report, and the pair is approaching a key area of confluence resistance.

The pair has seen a bounce higher last week following a sharp decline to the 0.7450 level, and is currently trading at what seems to be a key technical zone between 0.7600 and 0.7575.

A clean break above the 0.76 handle might put focus on the 0.7650 level which coincides with a long term potential trend line resistance from 2013. A break above this level could expose the 0.77 handle followed by what seems to be a significant area of resistance around the April highs, 0.7800 and the 0.382 Fib of the last monthly leg lower from July 2014.

A move below the 0.7575 level might put focus initially on the 0.75 handle for possible support, followed by the round 00s and 50s with possible channel trend line support running through those areas.

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing that about 44.0% of traders are long the AUD/USD at the time of writing. The SSI is mainly used as a contrarian indicator, implying a slight long bias.

You can find more info about the DailyFX SSI indicator here.

AUD/USD Daily Chart: August 1, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

Follow him on Twitter at @OdedShimoni