Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader and see ideas on other USD crosses

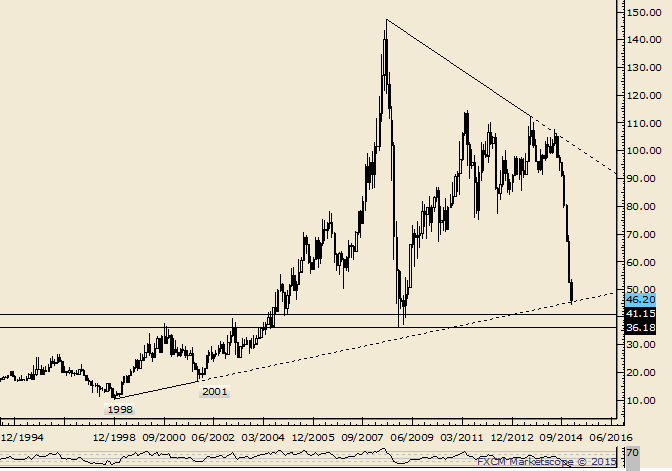

-“With crude in freefall, it’s a good time to step back and look at where massive support could reside. Well, the line that extends off of the 2001 and 2008 lows intersects a lower parallel this month and the next at the 78.6% retracement of the advance from 2008 at 53. While the market is clearly extreme and therefore prone to a reversal now, 53 looks great for a significant low.”

-Crude was able to find minor support near 53 but the market now trades with a 4 handle. The line that extends off of the 1998 and 2001 lows has been reached. A weekly close above the line would be a positive.

--Tradingideas are availabletoJ.S. Trade Desk members.