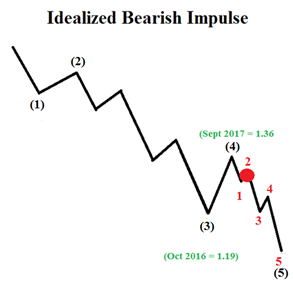

GBP/USD has been strengthening recently on the heels of a poor performing US Dollar. The longer-term picture for GBP/USD is not as rosy. The longer-term forecast is for Cable to retest 1.19. The question becomes, has the high been set for this move lower? The Elliott Wave model would agree the September high was an important high.

New to FX trading? We created this guide just for you.

In our previous report, we were unsure if the minor wave 2 was finished or not. It turns out GBP/USD needed to subdivide a bit higher. On an intraday chart (below), GBP/USD is approaching the 61.8% retracement of the September to October downtrend at 1.3417. This may provide strong resistance as we are anticipating a partial retracement of the September to October downtrend.

GBP/USD Elliott Wave Count Nov 27

We think this partial retracement higher is a minor wave ‘2’ of a five wave motive wave. Therefore, we appear to be early in downtrend.

Sentiment is not strong now at -1.23. This means the majority of the traders in GBP/USD are short the market. In fact, the number of short traders has been growing while the number of long traders has been falling. Sentiment is an excellent contrarian tool so this signals additional gains for GBP/USD. Our Elliott Wave analysis suggests a shorter-term top is looming nearby. Keep an eye on the live sentiment reading as a shift towards bulls may provide an early warning signal of a top.

The key level to the bearish bias is the September 20 high of 1.3657.

Struggling with your trading? This could be why.

Get started learning about Elliott Wave. Grab the beginner and advanced Elliott Wave trading guide.

---Written by Jeremy Wagner, CEWA-M

Discuss this market with Jeremy in Monday’s US Opening Bell webinar.

For further study on Elliott Wave patterns, watch these one hour long webinar recordings devoted to each topic. [registration required]

Follow on twitter @JWagnerFXTrader .

Join Jeremy’s distribution list.

Other Elliott Wave forecasts by Jeremy:

EUR/USD Elliott Wave analysis points to higher level.

Gold price pattern still bearish yet silver prices sport a cleaner pattern. [Webinar recording]