Gold, XAU/USD, Silver, XAG/USD, Technical Analysis, Retail Trader Positioning - Talking Points

- Fundamental analysis hints gold, silver may continue falling

- Retail trader bets offer upside view on gold, downside for silver

- How are technicals aligning with the fundamentals, positioning?

Gold and Silver prices have been struggling to find upside momentum in recent weeks amid global efforts from central banks to tame high inflation. This is making for a difficult fundamental environment for these anti-fiat precious metals. How have retail traders been positioning themselves in XAU/USD and XAG/USD amid recent price action and what could that mean for the road ahead? For a deeper dive into the analysis, check out this week’s webinar recording above.

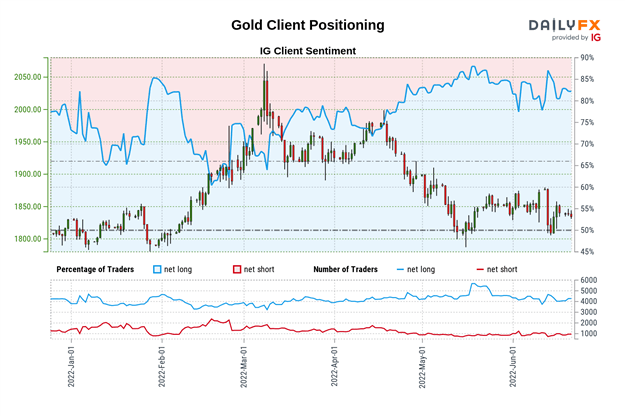

Gold Sentiment Outlook - Bullish

The IGCS gauge shows that about 81% of retail traders are net-long gold. IGCS tends to function as a contrarian indicator. As such, the fact that traders remain net-long hints prices may continue falling. However, short bets have climbed by 2.2% and 20.32% compared to yesterday and last week respectively. With that in mind, recent changes in sentiment warn that gold could reverse higher.

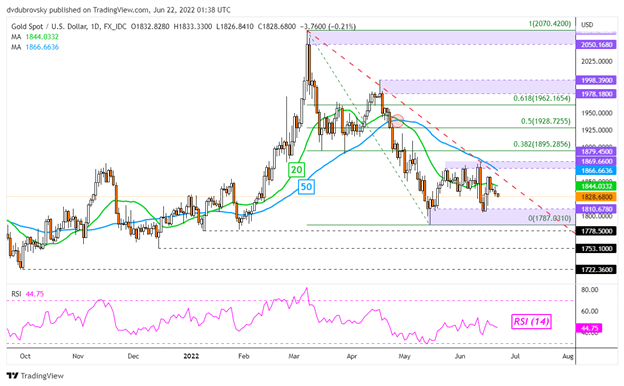

XAU/USD Daily Chart

On the daily chart, XAU/USD remains in a downtrend since early March, but recent price action is looking neutral. The yellow metal appears to be consolidating between resistance (1869 – 1879) and support (1787 – 1810). In fact, it seems that gold could form a Bearish Rectangle. Breaking under the range of support could be a sign of downtrend resumption. That would place the focus on lows from December. Otherwise, pushing above resistance could shift the outlook increasingly bullish.

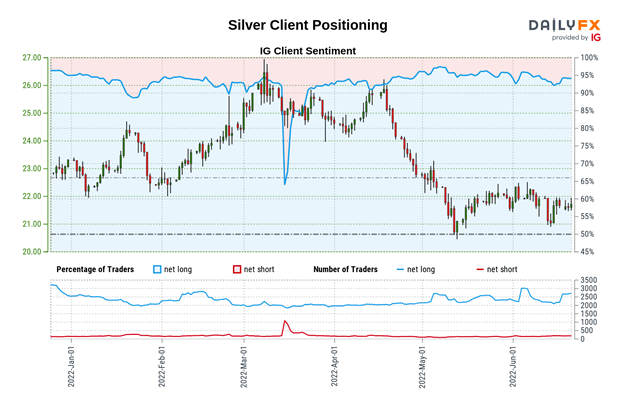

Silver Sentiment Outlook - Bearish

The IGCS gauge shows that roughly 95% of retail investors are net-long silver. Since nearly the absolute majority of traders are positioned to the upside, this is a sign that prices may continue falling. Downside exposure has been falling recently, declining by 12.79% and 33.92% versus yesterday and last week respectively. With that in mind, the combination of current readings and recent changes in IGCS hint that Silver may remain biased to the downside.

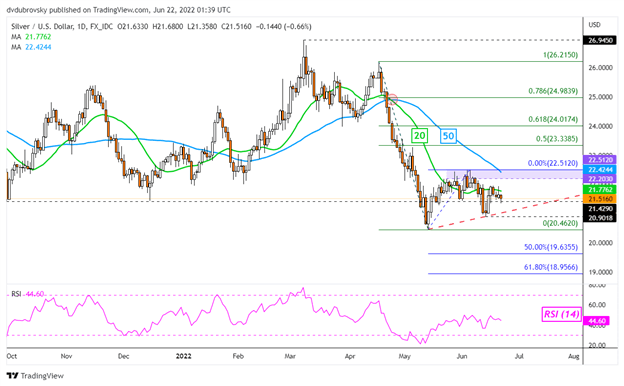

XAG/USD Daily Chart

Similar to gold, silver prices have been in a downtrend since early March. Recent price action has been looking neutral as well. A Bearish Death Cross remains between the 20- and 50-day Simple Moving Averages (SMAs), offering a downside bias. Key support seems to be the May low at 20.46. Clearing the latter exposes the midpoint of the Fibonacci extension at 19.63. Otherwise, clearing resistance (22.20 – 22.51) opens the door to a bullish technical outlook.

*IG Client Sentiment Charts and Positioning Data Used from June 21st Report

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter