Dow Jones, Crude Oil, USD/CAD, Trader Positioning - Talking Points

- IG Client Sentiment hints Dow Jones may continue higher

- Crude oil price outlook bullish as short bets accumulate

- USD/CAD downtrend may extend as long bets increase

In this week’s webinar on IG Client Sentiment (IGCS), I discussed the outlook for the Dow Jones, crude oil and USD/CAD. IGCS is a contrarian indicator. For a deeper dive into what this means and for fundamental analysis, check out the recording of the session above.

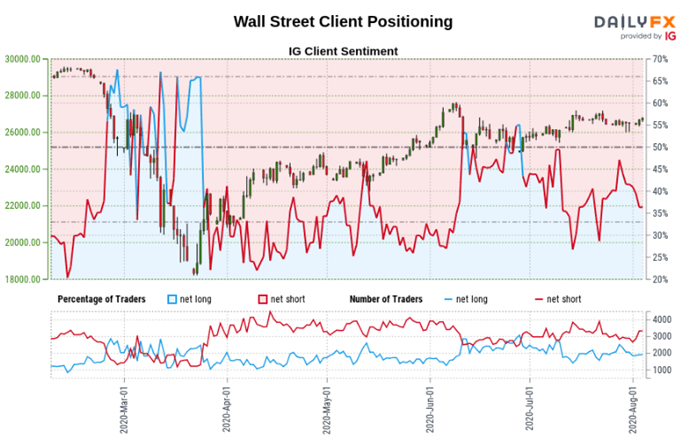

Dow Jones Sentiment Outlook - Bullish

The IGCS gauge implies that 34.36% of retail traders are net long the Dow Jones. Downside exposure has increased by 10.52% and 5.83% over a daily and weekly basis respectively. The combination of current sentiment and recent changes offers a stronger bullish contrarian trading bias.

Develop the discipline and objectivity you need to improve your approach to trading consistently

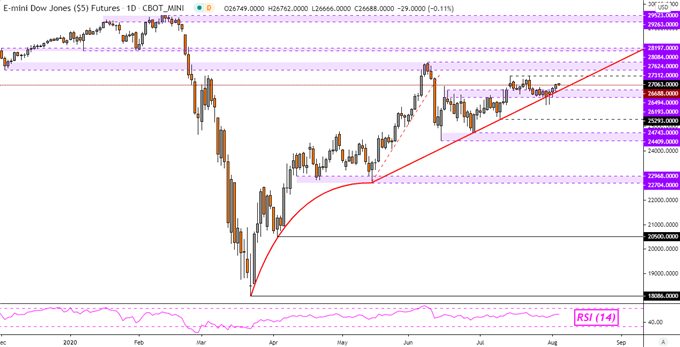

Dow Jones Technical Analysis

Rising support from early May appears to be maintaining the upside bias in Dow Jones futures, red line on the daily chart below. That has placed the focus on immediate resistance at 27063 before prices could push towards the 27312 – 27624 inflection zone established in December. Taking out the trend line and the 26193 – 26494 inflection range below may open the door to losses.

Dow Jones Futures – Daily Chart

Dow Jones Chart Created in Trading View

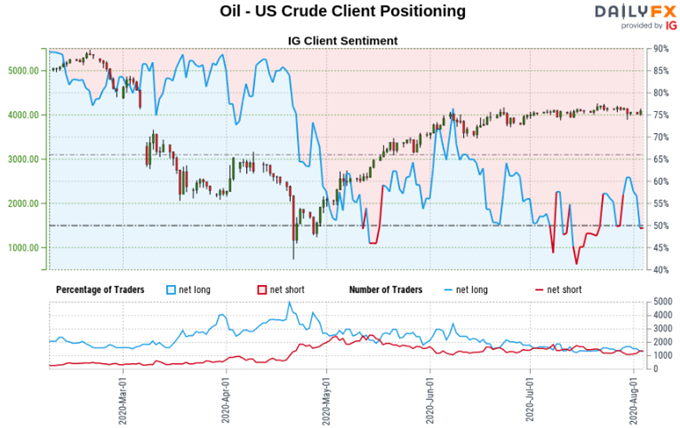

Crude Oil Sentiment Outlook - Bullish

The IGCS gauge implies that about 43% of traders are net long WTI crude oil. Net short positioning has increased by 14.09% and 28.42% over a daily and weekly basis respectively. The combination of current sentiment and recent changes offers a more compelling bullish contrarian trading bias.

Crude Oil Technical Analysis

WTI crude oil prices remain stuck in range-bound trade, hovering around the key 40.42 – 41.60 inflection zone. Immediately below is the 50-Day Simple Moving Average (SMA) which is acting as key support. A drop under the SMA places the focus on 37.10 while a push higher exposes the February low at 43.87.

WTI Crude Oil – Daily Chart

Crude Oil Chart Created in Trading View

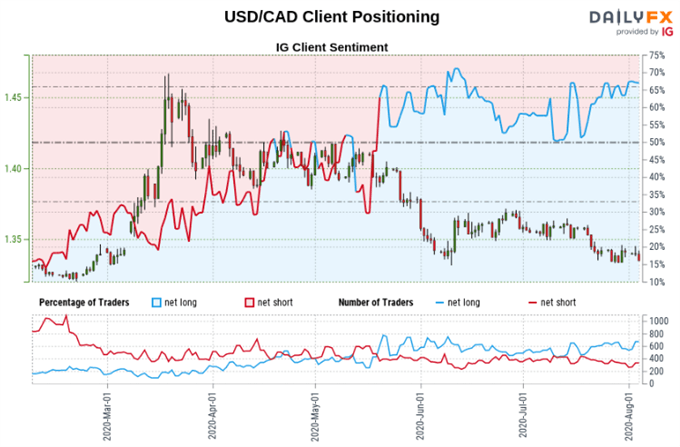

Canadian Dollar Sentiment Outlook - Bearish

The IGCS gauge implies that 67.37% of USD/CAD traders are net long. Exposure to the downside has decreased by 5.23% and 17.65% over a daily and weekly basis respectively. With that in mind, the combination of current sentiment and recent changes offers a stronger bearish contrarian trading bias.

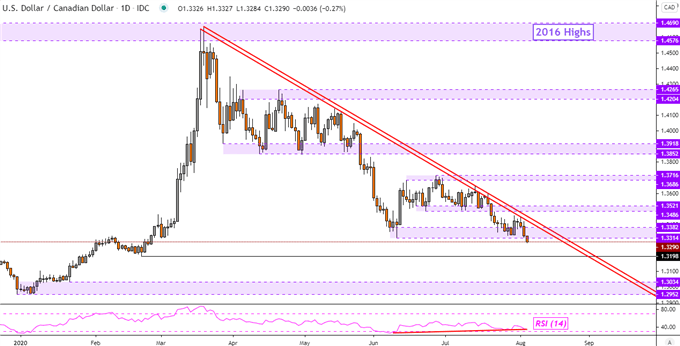

Canadian Dollar Technical Analysis

USD/CAD is attempting to clear the June low at 1.3314, opening the door for resuming the dominant downtrend. That has exposed the February low at 1.3198 as key support next. Positive RSI divergence does show that downside momentum is fading. This can at times precede a turn higher.

USD/CAD – Daily Chart

USD/CAD Chart Created in Trading View

*IG Client Sentiment Charts and Positioning Data Used from August 4th Report

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter