Australian Dollar, New Zealand Dollar, AUD/NZD Technical Analysis – TALKING POINTS

- AUD/NZD has rallied over five percent since bottoming out at a 5-year low

- Pair’s upside momentum may be amplified after it broke key resistance zone

- However, AUD/NZD’s rally could lose steam as it eyes a formidable ceiling

AUD/NZD Technical Analysis

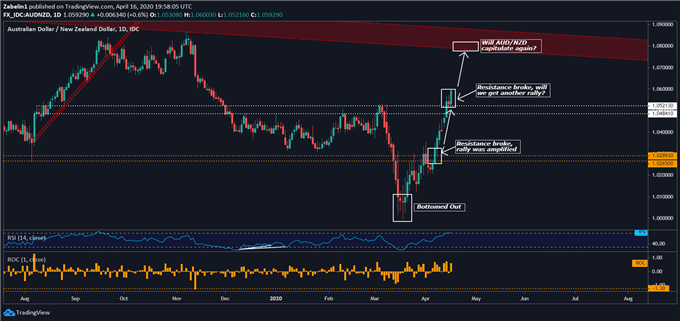

AUD/NZD has rallied over five percent since bottoming out at a five-year low at 1.0074. Along its ascent, the pair shattered several former support-turned-resistance ranges with the most recent one cleared between 1.0484 and 1.0521 (white-dotted lines).

AUD/NZD – Daily Chart

AUD/NZD chart created using TradingView

Since the breach was met with follow-through, it could catalyze another bullish surge similar to what traders saw the last time it broke a resistance range between 1.0265 and 1.0289 (gold-dotted lines). However, while markets may see bold price action at first, traders may become more timid as the AUD/NZD approaches a five-year descending resistance channel.

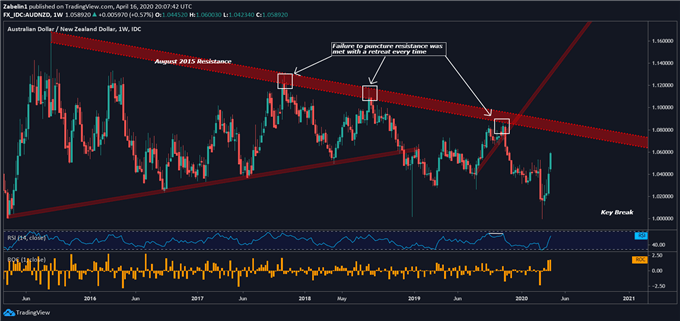

AUD/NZD – Weekly Chart

AUD/NZD chart created using TradingView

The descending ceiling has proven to be a formidable and fortified obstacle that AUD/NZD has been unable to clear for five years. Looking at a weekly chart shows how every failed attempt was subsequently met with an aggressive decline. True, AUD/NZD has staged a remarkable recovery over the past few weeks, but the pair’s gains could be at risk if another attempt to clear resistance is met with failure and a subsequent selloff.

AUSTRALIA DOLLAR TRADING RESOURCES:

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter