USD/CAD Technical Analysis:

- Canadian Dollar technical trade levels – Daily and Weekly Charts

- USD/CAD pushes higher after week of consolidation around the weekly open

- IG Client Sentiment suggests a ‘mixed’ trading environment despite heavy long positioning

USD/CAD Technical Outlook: Weekly View and Daily Trade Levels

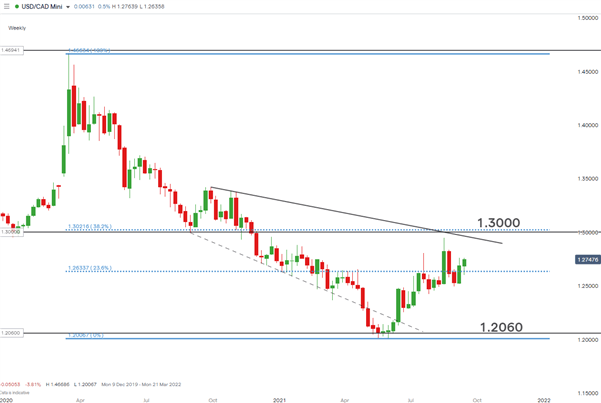

USD/CAD looks to have bottomed out in June this year as prices have traded higher ever since. However, the bullish momentum has not exactly been straight-forward as we have witnessed price spikes and deep pullbacks recently.

The weekly chart shows two consecutive weeks of gains but prices are still a fair distance away from the recent high – contributing to the mixed trading bias. Those looking for bullish continuation plays will be interested to see if next week USD/CAD remains above the 23% Fib level (drawn from the march 2020 high to the May 2021 low) at 1.2630.

USD/CAD Weekly Chart

Chart prepared by Richard Snow, IG

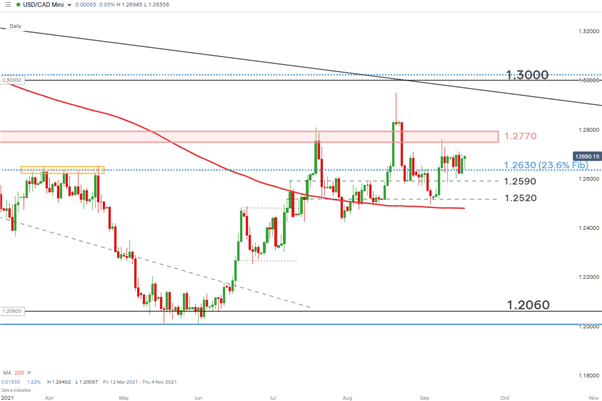

Heading into the week which plays host to the last scheduled Fed meeting of Q3, markets may be anticipating a more hawkish message as the dollar continued to trade higher against its peers in the lead up. Continued dollar strength cannot be ruled out but the current technical setup offers very little as far as bullish or bearish biases are concerned, apart from the broader uptrend which remains intact.

Breaks of the immediate support and resistance levels may provide an indication of future price action in the search of strong one-sided momentum to propel this market out of the current consolidation.

The nearest zone of resistance comes in around 1.2770 (red zone) with a really large stretch needed to retest the August high. The 23% Fib mentioned earlier, acted as resistance during March and April and now provides a near-term level of support, followed by the 1.2590 level and finally, the 1.2520 mark

USD/CAD Daily Chart

Chart prepared by Richard Snow, IG

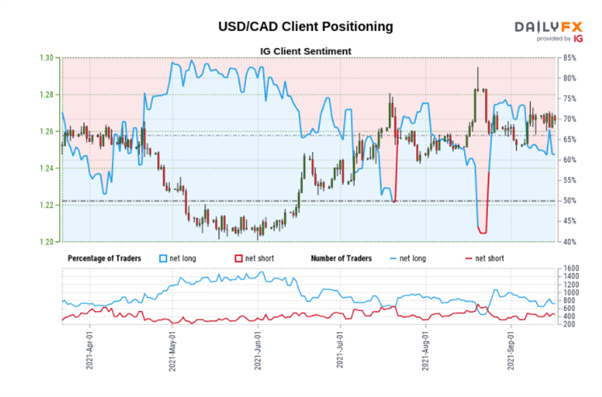

USD/CAD Sentiment Reflects Current Trading Environment: Mixed

IG client long sentiment has reduced drastically since USD/CAD printed its low and although a healthy portion of traders remain long, the outlook remains mixed.

- USD/CAD: Retail trader data shows 68.21% of traders are net-long with the ratio of traders long to short at 2.15 to 1

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

- The number of traders net-long is 8.26% lower than yesterday and 7.28% higher from last week, while the number of traders net-short is 0.53% lower than yesterday and 17.47% lower from last week.

- Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CAD trading bias.

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX