Dow Jones, S&P 500, Nasdaq 100 Technical Forecast: Neutral

- The Dow, S&P 500 and Nasdaq 100 all put in net losses on the week; but considering the prevailing factors, the fact that they didn’t drop more may count as a win for bulls.

- While inflation and Powell were very much the focus this week, next week sees the attention shift to US earnings releases with a number of large caps reporting.

- Despite another massive inflation print, Powell spent two days on Capitol Hill explaining why the Fed retains an uber-dovish policy outlook. This helped to push Treasury yields lower, with the 10-year dipping below 1.3%.

Well, it was a big week of drivers and once again, inflation surprised to the upside. US CPI data was released on Tuesday to the eye-popping tune of 5.4% and stocks barely shrugged. As a matter of fact, only a couple hours after that release – the S&P 500 set yet another fresh all-time-high. This was perhaps driven by what was on the economic calendar in the two days following, and that was an appearance from FOMC Chair Jerome Powell as part of the Fed’s twice-annual Humphrey Hawkins testimony.

Then on Thursday after US markets had closed, an interview with US Treasury Secretary Janet Yellen hit the airwaves, in which she said she sees ‘several more months of rapid inflation’ before price pressures ease. US equity markets opened on Friday to a heavier offer, with prices continuing to pullback after the early-week gains, and that selling pressure persisted throughout the session.

But, to put this in scope, the past two months have been pretty outlandish, even by 2020 definitions of the word. The Nasdaq 100 jumped by as much as 15% from the mid-May low, and the big driver there was the June FOMC rate decision in which the bank got a bit less dovish. But that meeting was now a month ago and focus has begun to shift towards risk events later this summer, such as Jackson Hole or the September FOMC rate decision, at which point the FOMC will offer updated projections and forecasts.

And that highlights one of Chair Powell’s comments this week, taken from his prepared remarks ahead of his Wednesday appearance, that seemed to overrule most of the other headline items: “Conditions in the labor market continue to improve, but there is still a long way to go.” Powell went on to remark that the Fed’s goal of ‘substantial further progress’ towards full employment and price stability remain ‘a ways off.’

This is the same rationale that’s been driving markets over the past two months and, even despite another surprising inflation print, with the Fed digging in their heels, it seems that little-to-nothing has yet changed on that front.

In the high-flying Nasdaq 100, prices started to re-test a bullish trendline that can be drawn from the May lows. The 15k level has proven tough to break and prices may need a deeper pullback to wash out recent longs before buyers can finally break-through. There’s a possible spot of higher-low support around 14,540, but if that can’t hold, it’s the 14k level that sticks out as a possible point of support. In between the two, the 38.2% retracement of the recent advance stands at 14,216, and this becomes an additional point of possible support.

Nasdaq 100 (NQ1) Daily Price Chart

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

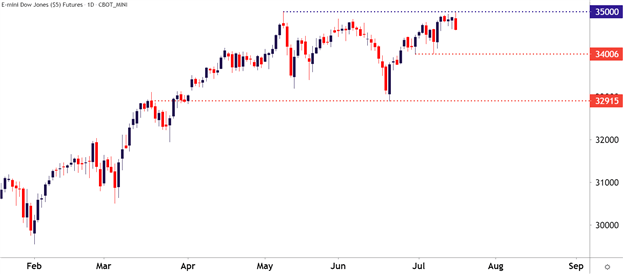

Dow Jones: The Return of Value?

While the Nasdaq 100 has been up as much as 15% from that May low, creating a series of fresh all-time-highs along the way, the Dow has yet to take-out that prior May swing-high.

But the past week saw the Dow make a comeback as prices jumped up towards that prior swing-high, just under the 35k psychological level, and this gives the appearance of bullish breakout potential ahead of next week. So, in a bizarre twist, the Dow may be set up in the most bullish manner currently amongst the three big US equity indices.

To learn more about psychological levels, join us in DailyFX Education

Dow Jones Daily Price Chart

Chart prepared by James Stanley; Dow Jones on Tradingview

S&P 500 Traverses the Wedge

The prior week saw a bit of excitement around the S&P 500, with the index pulling back on Thursday to trendline support. But the move on the Friday following that sell-off was a pronounced bullish engulfing candlestick that propelled price action to another trendline, helping to mark resistance on a rising wedge pattern.

That bullish engulfing candlestick led into another move of strength on Monday, with prices setting that fresh all-time-high, with another showing up in US markets on Tuesday a few hours after that 5.4% CPI print.

While rising wedge formations will often be approached with the aim of bearish reversals, given the length and force of the move, there’s not yet a bearish trigger nearby. For that scenario to begin to set up, traders would likely want to look for a test below near-term support around 4280, followed by a test of longer-term support around 4127. That could begin to set a reversal framework into motion.

To learn more about the rising wedge, check out DailyFX Education

S&P 500 Daily Price Chart

Chart prepared by James Stanley; S&P 500 on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX