Technical Forecast for the US Dollar: Bullish

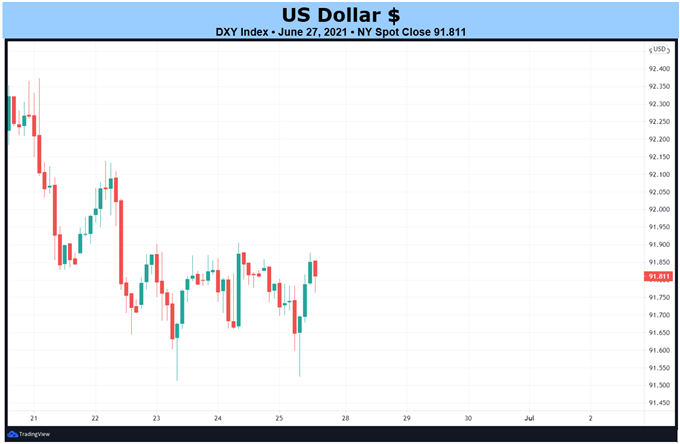

- The US Dollar (via the DXY Index) has begun to trade in a sideways consolidation ahead of the June US nonfarm payrolls report.

- US Dollar positioning is now at its lowest net-long level since it flipped to net-long the week ended March 16.

- The IG Client Sentiment Index suggests that the US Dollar has a different bias against its three major counterparts.

US Dollar Rates Week in Review

Gains accumulated around the June Federal Reserve meeting dissipated over last week as the US Dollar (via the DXY Index) dropped amid a steady stream of Fed speakers soothsaying markets about the pacing of stimulus withdrawal. A retrenchment in US Treasury yields coupled with US equity markets moving to all-time highs diminished demand for the world’s reserve currency, with the DXY Index closing out the week down by -0.55%.

But with technical evidence emerging that traders aren’t ready to say that US Dollar’s gains may not be finished – long wicks on the daily charts at the end of the week suggest demand for the DXY Index is firming around 91.50 – there may be more upside potential with significant event risk coming down the pipeline: the June US nonfarm payrolls report is due on this coming Friday.

For full US economic data forecasts, view the DailyFX economic calendar.

DXY INDEX PRICE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to June 2021) (CHART 1)

The DXY Index experienced a bullish breakout when it overcame both short-term bear flag resistance and the multi-month bear flag support that defined price action beginning in late-November 2020. The reversal within the multi-month consolidation suggests that more upside may be possible. Now, the DXY Index has is stuck in familiar territory around the 23.6% Fibonacci retracement of the 2018 low/2020 high range and the 38.2% Fibonacci retracement of the 2011 low/2020 high range near 91.90.

Signs are emerging the bullish momentum is firming. The daily 5-EMA is proving as support as the entire daily EMA envelope has aligned in bullish sequential order. Daily MACD is rising while in bullish territory, while daily Slow Stochastics are pointed higher just below overbought territory. If the DXY Index has been consolidating in a broader symmetrical triangle dating back to last September, then it may be the case that a run towards triangle resistance near 92.75 may be in the cars soon.

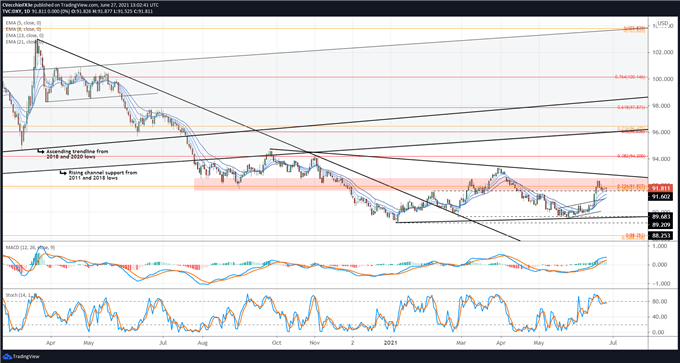

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to June 2021) (CHART 2)

As the largest component of the DXY Index, technical weakness in EUR/USD rates reinforces the view that the DXY Index may have more upside left in the tank. EUR/USD rates are struggling below the 23.6% Fibonacci retracement of the 2020 low/2021 high range (1.2033) as momentum sours.The pair is below its daily 5-, 8-, 13-, and 21-EMA envelope, which is in bearish sequential order. Daily MACD is falling in bearish territory while daily Slow Stochastics are pointed lower, near oversold territory. A deeper setback towards the March low at 1.1704 may transpire soon.

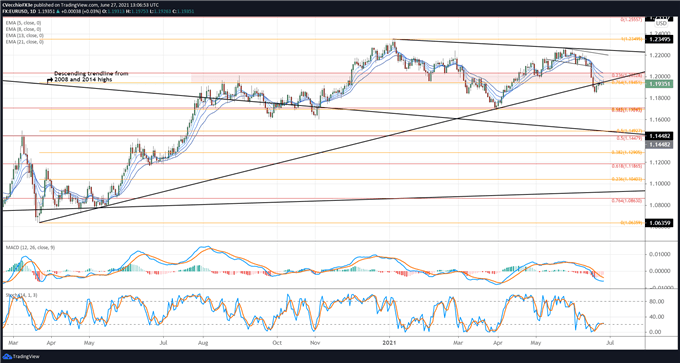

IG Client Sentiment Index: EUR/USD Rate Forecast (June 25, 2021) (Chart 3)

EUR/USD: Retail trader data shows 53.05% of traders are net-long with the ratio of traders long to short at 1.13 to 1. The number of traders net-long is 8.31% lower than yesterday and 4.61% lower from last week, while the number of traders net-short is 5.13% lower than yesterday and 11.67% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

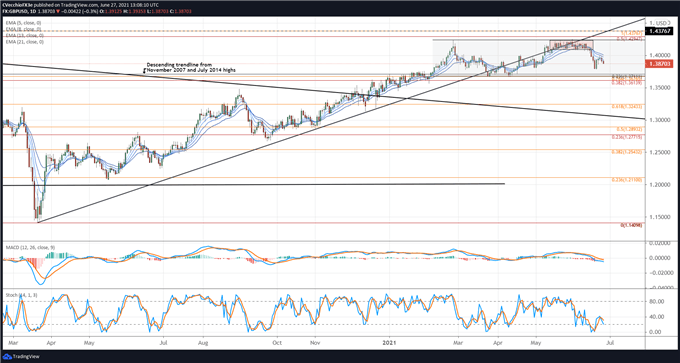

GBP/USD RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to June 2021) (CHART 4)

Last week, GBP/USD rates dropped out of a sideways range that encompassed price action for a month, but the losses have not been extreme: the broader sideways range in place since early-February, between 1.3660 and 1.4250, continues to encompass price action. Momentum has turned bearish, however. The daily EMA envelope has become resistance, in particular the daily 5-EMA. Daily MACD is descending while in bearish territory, while daily Slow Stochastics have turned lower below their signal line. Further losses towards range support around 1.3700 may be in the cards.

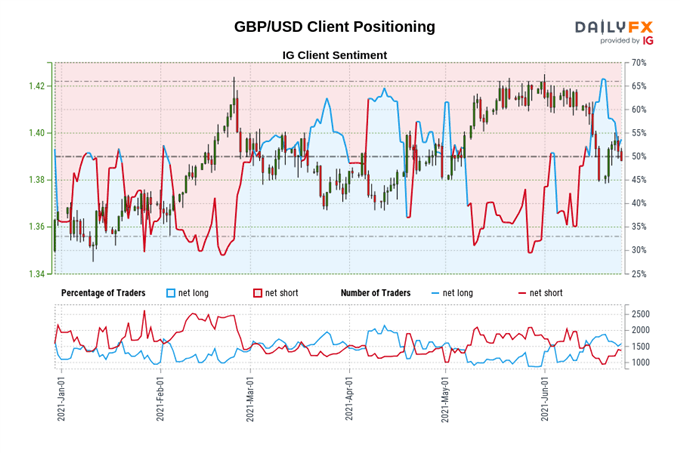

IG Client Sentiment Index: GBP/USD Rate Forecast (June 25, 2021) (Chart 5)

GBP/USD: Retail trader data shows 55.51% of traders are net-long with the ratio of traders long to short at 1.25 to 1. The number of traders net-long is 0.24% higher than yesterday and 11.68% lower from last week, while the number of traders net-short is 1.61% lower than yesterday and 34.63% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

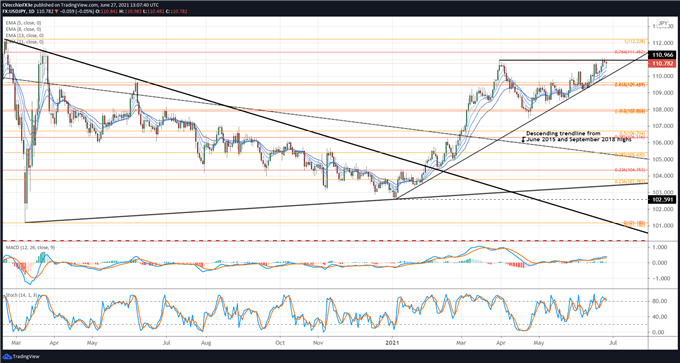

USD/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (June 2020 to June 2021) (CHART 6)

Thanks to the sustained premium in US Treasury yields above JGB yields, USD/JPY appears on more bullish footing than the broader DXY Index.USD/JPY rates are pressing resistance in theascending triangle that’s been forming since the yearly low was established in January. Contextually, the expected outcome is for a bullish resolution, given that the preceding move was a rally following the break of the descending trendline from the June 2015 and September 2018 highs. Traders should be on alert for a breakout.

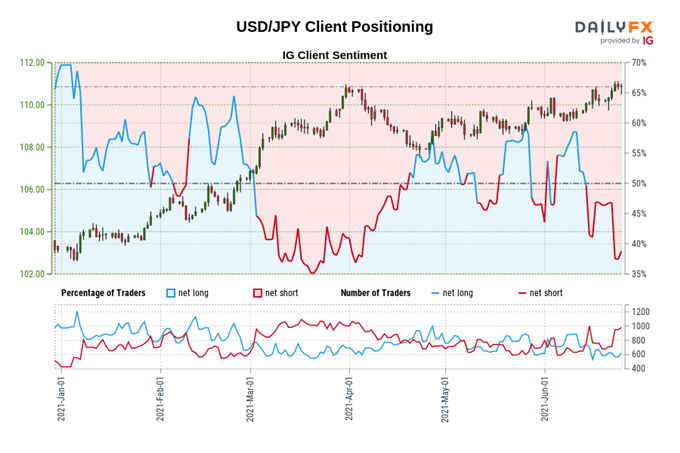

IG Client Sentiment Index: USD/JPY Rate Forecast (June 25, 2021) (Chart 7)

USD/JPY: Retail trader data shows 39.00% of traders are net-long with the ratio of traders short to long at 1.56 to 1. The number of traders net-long is 11.22% lower than yesterday and 12.92% lower from last week, while the number of traders net-short is 10.76% lower than yesterday and 22.17% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

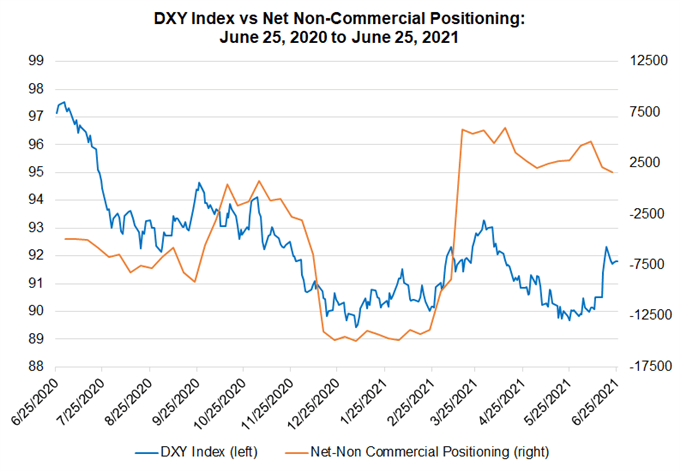

CFTC COT US Dollar Futures Positioning (June 2020 to June 2021) (Chart 8)

Finally, looking at positioning, according to the CFTC’s COT for the week ended June 22, speculators decreased their net-long US Dollar positions for the second week in a row to 1,643 contracts, down from 2,138 contracts held in the week prior. US Dollar positioning is now at its lowest net-long level since it flipped to net-long the week ended March 16.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist