US Dollar, EUR/USD, GBP/USD, USD/CAD, AUD/USD - Technical Forecast

- US Dollar cautiously gained this past week, will momentum hold?

- EUR/USD following falling resistance, GBP/USD consolidating

- USD/CAD uptrend in focus, is AUD/USD stalling after its rise?

US Dollar Broader Picture

My majors-based US Dollar index pushed above key falling resistance from last month’s top earlier in April. The index averages USD against EUR, JPY, GBP and AUD. That brought a notable pause in losses as the Dollar shifted into a more neutral setting. Yet upside commitment seems to have been struggling as of late and the week ahead could offer a better picture of the validity behind a resumption of the prior uptrend.

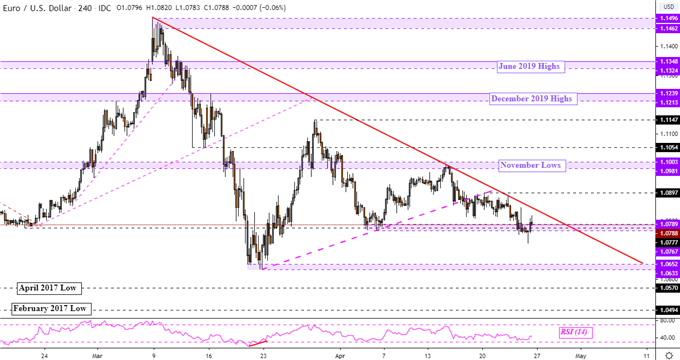

EUR/USD Technical Outlook

The Euro resumed depreciating against the US Dollar this past week after EUR/USD took out rising support from last month’s bottom. Maintaining a cautiously bearish bias in the pair is falling resistance from March’s top – red line on the 4-hour chart below. Yet losses paused as prices struggled closing under key support (1.0767 – 1.0789) as a lower shadow was left behind. This could precede a retest of falling resistance that may reinstate the downward trajectory towards 1.0633. A turn higher exposes 1.0897 on the way towards 1.1003.

EUR/USD 4-Hour Charts

EUR/USD Chart Created in TradingView

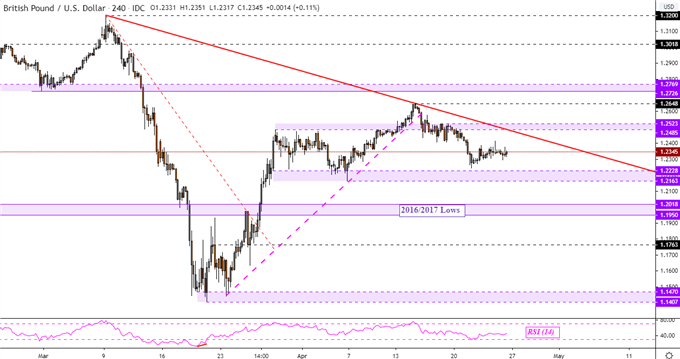

GBP/USD Technical Outlook

The British Pound also extended losses against the US Dollar after GBP/USD closed under rising support from March’s bottom. Guiding the pair cautiously lower appears to be a falling trend line from March’s top at 1.3200. For the time being, the pair seems to be in a consolidation mode with the lower boundary at 1.2163 and the upper one at 1.2523. The direction of breakout with a confirmatory close could precede the next defining trend. A turn lower places the focus at 1.2018 while a push higher may expose 1.2648.

| Change in | Longs | Shorts | OI |

| Daily | 0% | 8% | 3% |

| Weekly | -14% | 37% | 2% |

GBP/USD4-Hour Chart

GBP/USD Chart Created in TradingView

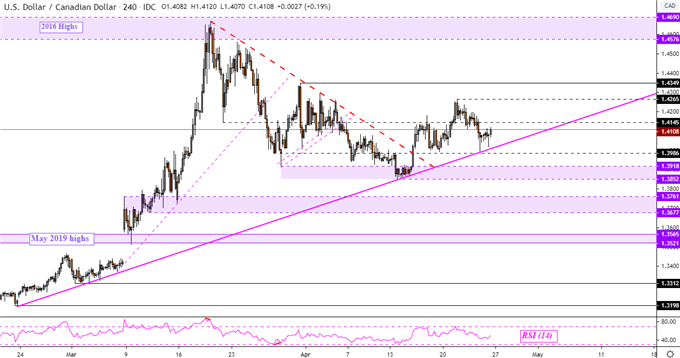

USD/CADTechnical Outlook

The US Dollar remains in a broad upward trajectory against the Canadian Dollar. Guiding USD/CAD to the upside since February is a rising trend line – pink line on the 4-hour chart below. Earlier this month, there was also a breakout above falling resistance from last month’s top. A push above 1.4145 exposes 1.4265 on the way towards 1.4349. A turn lower through 1.3986 with confirmation could open the door to a broad reversal of the dominant downtrend. This would expose a key range of support between 1.3852 to 1.3918.

For timely updates on US Dollar price action, you may follow me on Twitter here @ddubrovskyFX

USD/CAD4-Hour Chart

USD/CAD Chart Created in TradingView

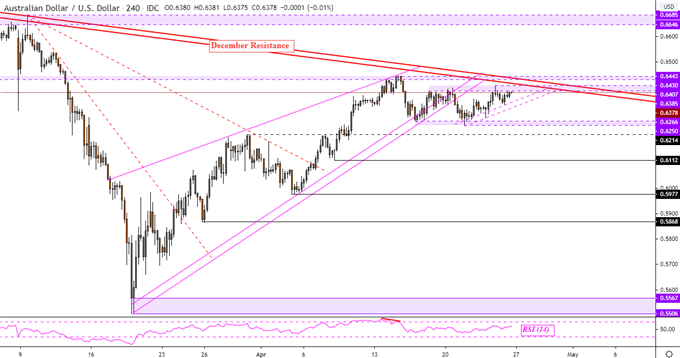

AUD/USD Technical Outlook

The Australian Dollar has broken under a rising wedge from last month’s bottom. Yet downside follow-through has been struggling as the prior bullish trend shifted to a more neutral setting. AUD/USD seems to be consolidating between 0.6250 to 0.6430. Yet falling resistance from December – red lines – are maintaining the broader downward bias. If prices pressure resistance ahead, taking out 0.6443 with confirmation could be a signal that bulls could regain momentum. Otherwise a turn lower exposes 0.6214 towards 0.6112.

AUD/USD4-Hour Chart

AUD/USD Chart Created in TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter