Euro, EUR/USD, EUR/JPY, EUR/CHF Price Analysis

- The single currency continued to sell-off through this week.

- EUR/USD has crafted a fresh two-year-low.

- Both EUR/USD and EUR/CHF are showing extreme sentiment reads, keeping the door open for continuation strategies.

Euro Breaks Down, EUR/USD to Fresh Two-Year Lows

The Euro has put in an aggressive bearish move to continue the single currency’s February slide. Against the USD, EUR/USD is now trading at fresh two-year-lows as a potent combo of both Euro-weakness and USD-strength have combined to take-control of the pair. Similarly, albeit to an abbreviated degree, EUR/JPY has broken-out to fresh lows, as well, but here, we’re looking at a fresh four-month-low rather than that of a multi-year variety. And even in EUR/CHF, sellers are getting more and more aggressive, pushing prices down to levels not seen since 2015, the year in which the Swiss National Bank removed the peg to the Euro at the 1.2000 marker, sending currency markets spiraling in disarray.

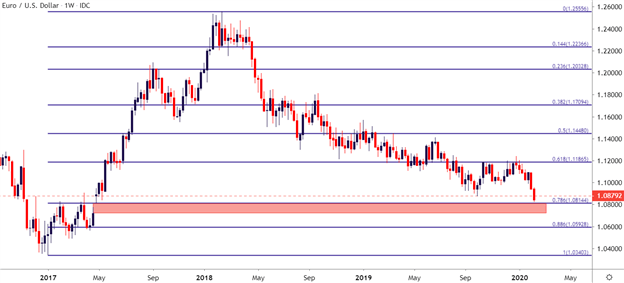

EUR/USD Falls to Fresh Two-Year-Lows

The current EUR/USD backdrop is very reminiscent of the April/May 2018 run, when Italian political risk was getting priced into the equation and the Euro had a very difficult time catching a bid. That weakness continued, albeit in a varied manner, for much of the next year until a big zone of longer-term chart support came into play around the 1.1212 level.

Another short-side trend developed in June of last year and ran into the October open; but for the four months since and coming into February, EUR/USD had largely remained in a choppy range; with the support zone around 1.1000 coming in to help hold the lows multiple times in Q4. This zone came back into play in late January for yet another support test, and when sellers pushed back in early-February, it started to look like breakdown potential might be brewing; and that’s precisely what happened.

Coming into this week, the pair had just tested below the 1.0955 support level, and sellers continued to push until the prior two-year-low at 1.0878 was taken-out on Wednesday of this week.

The primary concern is just how oversold this move has become. RSI on the daily chart is currently at 24, and this can make the prospect of chasing the move that much more difficult. But, current sentiment remains heavily long with retail traders apparently trying to call a bottom and this keeps the door open for further losses in the pair.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

EUR/USD Technical Forecast: Bearish

EUR/USD Weekly Price Chart

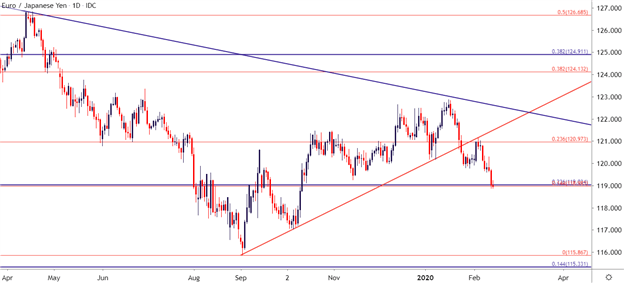

EUR/JPY Runs into Confluent Support

Similarly, EUR/JPY pushed-lower throughout the week, crafting fresh four-month-lows on the chart. The big difference here from the above look in EUR/USD is that EUR/JPY ran into a confluent zone of support as taken from a couple of different Fibonacci levels around the 119.00 handle. The 14.4% retracement of the 2018-2019 major move rests at 118.98 while the 23.6% retracement of the 2014-2016 major move resides at 119.03.

This zone came into play on Thursday of this week and seemingly helped to soften the slide in the pair; and when combined with the fact that retail sentiment isn’t as aggressively trying to buy the Euro here, EUR/JPY can be a candidate for fade plays or for those that’d like to incorporate reversal themes around the Euro.

| Change in | Longs | Shorts | OI |

| Daily | -9% | 0% | -3% |

| Weekly | 17% | -22% | -11% |

EUR/JPY Technical Forecast: Neutral

EUR/JPY Daily Price Chart

EUR/CHF Slides to Four-Year-Lows

As evidence of just how aggressive Euro sellers have become, EUR/CHF has slid down to levels not seen since 2015, which is the year that the Swiss National Bank finally abandoned the 1.2000 peg on EUR/CHF. After Switzerland was called out as a currency manipulator by the US Treasury Department, the SNB may not have such an easy path to Franc-weakness any longer; and this has allowed for Euro sellers to really dig in their heels in pushing the pair lower.

This has also led to a massive imbalance in retail positioning on the pair, with nearly seven traders long for every one that’s short. This, combined with the stark bearish run and the potential inability of the Swiss National Bank to counter that currency-strength, the forecast will be set to bearish for the week ahead.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -11% | -3% |

| Weekly | 2% | -20% | -5% |

EUR/CHF Technical Forecast: Bearish

EUR/CHF Weekly Price Chart

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX