British Pound Talking Points

- GBP/USD may face range bound conditions ahead of the Brexit deadline as the decline from earlier this month fails to spur a test of the December low (1.2896).

Technical Forecast for British Pound: Bullish

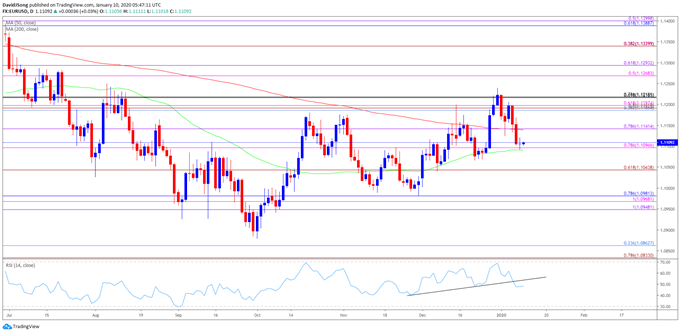

GBP/USD has been largely influenced by the Brexit saga as the UK remains committed in leaving the European Union (EU), but the exchange rate may face range-bound conditions ahead of the January 31 deadline as the reversal from the 2019 low (1.1958) appears to have run its course.

During the correction, GBP/USD took out the March high (1.3381), with the appreciation in the exchange rate pushing the Relative Strength Index (RSI) above 70 and into overbought territory.

However, GBP/USD appears to be stuck within the December range as the decline fromthe start of 2020 fails to generate a test of last month’s low (1.2896). Developments in the RSI highlight a similar dynamic as the oscillator falls back from overbought territory, with the indicator snapping the upward trend from August.

In turn, GBP/USD may continue to consolidate as the bullish momentum abates, and the exchange rate may stage a larger rebound over the coming days as it carves a series of higher highs and lows from the weekly low (1.2954).

GBP/USD Daily Chart

Source: Trading View

The technical outlook for GBP/USD has become less eventful compared to the volatility seen at the end of 2019 as the decline from the start of the yearappears to have stalled ahead of the December low (1.2896).

As a result, GBP/USD may face range-bound conditions ahead of the Brexit deadline as the Fibonacci overlap around 1.2890 (23.6% expansion) to 1.2950 (23.6% expansion) appears to be providing support, which largely lines up with the December low (1.2896).

The rebound from the monthly low (1.2954) may gather pace as GBP/USD carves a series of higher highs and lows, with a break/close above 1.3090 (38.2% retracement) raising the scope for a move towards the overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.