Euro Technical Forecast Talking Points

- Near-term bullish signals hint EUR/USD may trade higher ahead

- Medium-term EUR/USD technical signs still offer bearish outlook

- EUR/JPY may fall to “flash crash” lows given bearish trading bias

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

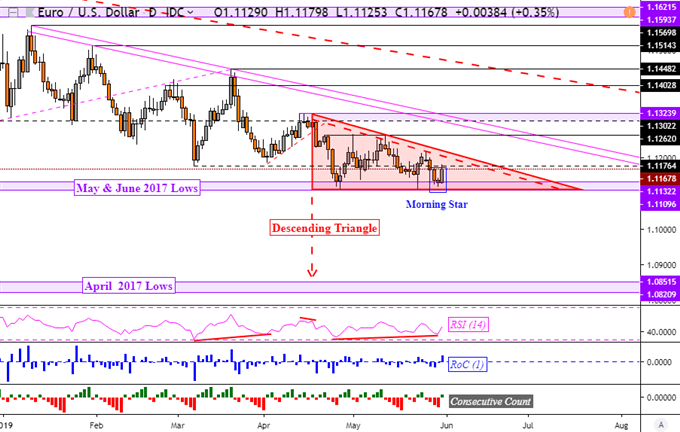

EUR/USDChart Outlook

This past week, the Euro continued trading within the boundaries of a Descending Triangle against the US Dollar. After the ceiling of the bearish candlestick pattern held, EUR/USD tested the floor just above 1.1110 as anticipated. In the week ahead, there may be a good chance that there will be another retest of the descending resistance line that has held since the middle of April.

That is because on the daily chart, EUR/USD left behind a bullish Morning Star that was accompanied by positive RSI divergence. The latter indicates fading momentum to the downside and can precede a turn higher. But, due to the Descending Triangle, I believe that the technical outlook in EUR/USD is bearish in the medium-term, overshadowing near-term bullish price signals.

Should there be a breakout to the upside, keep a close eye on 1.1262 as it could act as near-term resistance. Otherwise, down the road, a descent through support at 1.1110 opens the door to eventually testing lows seen back in April 2017. You may follow me on Twitter here @ddubrovskyFX for timely fundamental and technical Euro updates.

EUR/USD Daily Chart

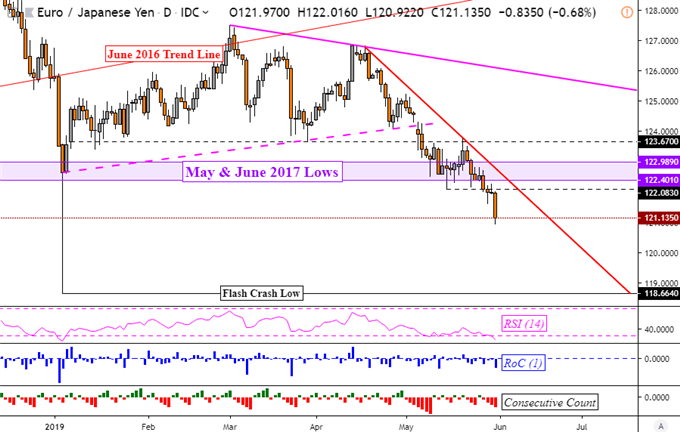

EUR/JPYChart Outlook

Unlike EUR/USD, the Euro brushed off bullish technical signals that hinted of a bottom against the Japanese Yen. Fundamentally, this likely owed to the anti-risk behavior in the Yen as fear of trade wars overwhelmed markets towards the end of last week. The roughly 0.7% drop in EUR/JPY on Friday fell through support, overturning positive RSI divergence that was initially hinting of a turn higher.

This leaves EUR/JPY facing the “flash crash” lows seen in the beginning of the year, where prices stopped short of 118.66 before quickly recovering. These are levels not seen since April 2017 as the currency pair continue to close at new lows this year. Meanwhile, a falling trend line from the middle of April is guiding EUR/JPY to the downside.

This resistance line is a clear hurdle for the pair to overcome in the event of a turn higher. But also, there is the psychological barrier, a range between 122.40 and 122.99, that is in the way of upside progress. Those are also lows touched back in May and June of 2017. If EU/JPY continues its progress lower, keep an eye for areas where it pauses. These will likely create new key support levels.

EUR/JPY Daily Chart

* Charts created in TradingView

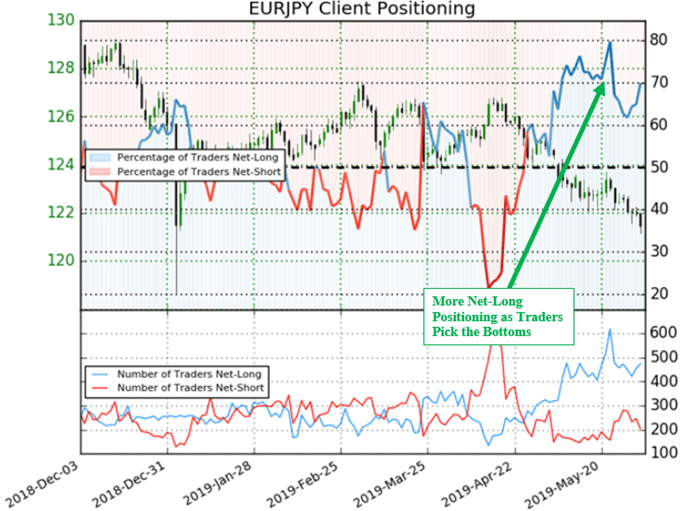

EUR/JPY Bearish Sentiment Signals

As EUR/JPY fell over 4.5% since the peak in mid-April, IG Client Positioning showed increased net-long positioning in the currency pair. This reflected higher bets that the currency could bottom, which is typically seen as a bearish-contrarian trading bias. This signal recently offered a stronger downside-contrarian outlook, complementing the bearish technical outlook in EUR/JPY on the next chart below.

Join me each week on Wednesday’s at 00:00 GMT as I reveal what else trader positioning has to say about prevailing trends in currencies, equities and commodities !

EUR/JPY IG Client Positioning

FX Trading Resources

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Euro is viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter