Talking Points:

- For the past week, the DXY Index has been moving in lockstep with US Treasury yields: the 5-day correlation with the 2-year yield is +0.77; with the 10-year yield it’s +0.94.

- A resolution to the two most pressing issues for the US Dollar – the government shutdown and the US-China trade war – would help US yields rise further, and therefore would help the greenback.

- Changes in retail trader positioning suggest an improving outlook in the near-term for the US Dollar.

See our long-term forecasts for the US Dollar, Euro, Yen, and other major currencies with the DailyFX Trading Guides.

Technical Forecast for the US Dollar: Neutral

The US Dollar is an unmoored currency. The US government shutdown has shuttered the doors of many federal agencies, including the Bureau of Economic Analysis and the Census Bureau, depriving traders of key reports like last week’s Retail Sales or this week’s Durable Goods Orders (assuming the government stays closed).

Consequently, without the ebb and flow of significant economic data spurring speculation over Federal Reserve rate policy, traders have fallen back to watching the headlines regarding the state of the government shutdown (note: US President Trump will give a speech at 15 EST/20 GMT on Saturday, January 19) and the US-China trade war.

The result has been that the US Dollar has closely hewed to the movements of other asset classes, tracking risk appetite broadly. For the past week, as equity markets and US Treasury yields go up, so too goes the US Dollar: the 5-day correlation with the 2-year yield is +0.77; and for the 10-year yield and the S&P 500, it’s +0.94 for both. Accordingly, with the DXY Index having returned back into the near-three-month consolidation following a false breakdown at the start of January – thereby upgrading its outlook from ‘bearish’ to ‘neutral’ in the process – traders may be best suited to continue to follow bonds and stocks for clues on the US Dollar’s next move.

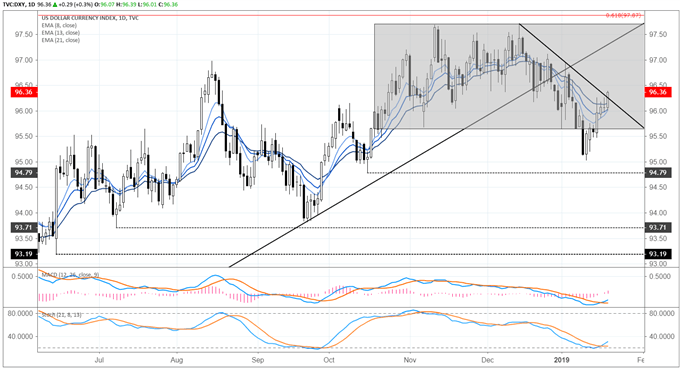

DXY Index Price Chart: Daily Timeframe (April 2017 to January 2019) (Chart 1)

The past week proved to be meaningful technically, with the DXY Index closing back above the entirety of its daily 8-, 13-, and 21-EMA envelope for the first time since December 26; the close on Friday through the daily 8-EMA came after having failed so after failing on Tuesday, Wednesday, and Thursday. In addition, the downtrend from the December 14 and January 2 highs was broken. Both daily MACD and Slow Stochastics have turned higher (albeit still in bearish territory).

To retake the rising trendline from the April and September 2018 lows, the DXY Index would need to get back above 97.30 by the end of the coming week. Accordingly, while near-term prospects have certainly improved on a short-term technical basis, more gains are needed in order to prompt a full upgrade into ‘bullish’ territory.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX.