What’s inside:

- EURUSD rally at risk into next week- key targets & invalidations levels

- Check out our New 3Q USD/CAD projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

EURUSD Weekly Chart

EURUSD has been trading within the confines of this broad ascending pitchfork formation extending off the 2016 & 2017 lows with prices rallying through the 50-line this week. A sliding parallel extending off the June 2016 highs comes in just higher into the 1.18-handle. Note that weekly momentum continues to hold in overbought territory and price is at risk for a push higher as long as this condition remains.

EURUSD Daily Chart

An embedded slope off the yearly lows further highlights near-term resistance just higher with the 2010 lows converging on the upper parallel next week at 1.1876. The long-bias is at risk heading into this slope with a break below 1.1616 needed to validate a near-term reversal / correction in the pair. The broader outlook remains constructive while above 1.1495 (bullish invalidation).

A breach above the upper parallel targets subsequent resistance objectives at the 2012 low at 1.2042 & the 50% retracement of the 2014 decline at 1.2167. Bottom line: from a trading standpoint I’ll be looking for an exhaustion high to fade while below the upper parallel heading into the close of the month. If we break down from here first, look for support into the median-line. Ultimately, I’d be interested in buying a larger correction in the pair.

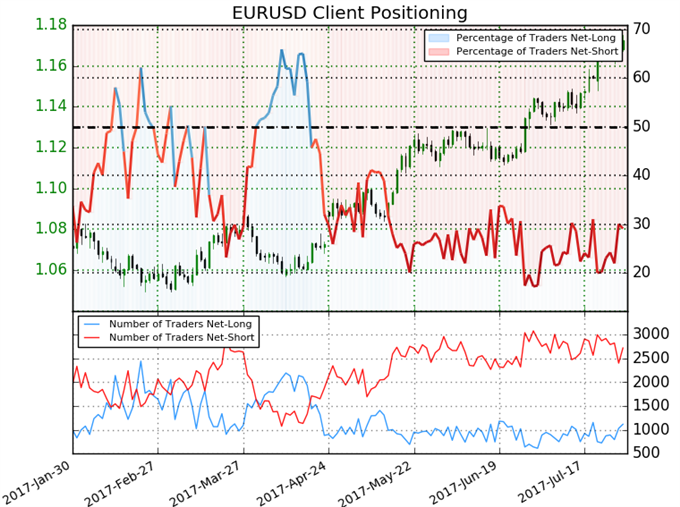

- A summary of IG Client Sentiment shows traders are net-short EUR/USD- the ratio stands at -2.43 (29.1% of traders are long) – bullishreading

- Retail traders have been net-short since April 18th- Price has moved 9.8% higher since

- Long positions are 6.2% higher than yesterday and 17.5% higher from last week

- Short positions are 1.6% higher from yesterday but 5.1% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rally. That said, retail is less net-short than yesterday and compared with last week and the recent changes in sentiment warn that the current price trend may soon reverse lower despite the fact traders remain net-short.

What to look for in EUR/USD retail positioning - Click here to learn more about sentiment!

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com